Breaking Through to Gen Z with Better Data

Amy Hou | January 29, 2018 | Credit & Lending

What do we know so far about Generation Z? We know that they are the youngest generation, born after 1995, so they’re not a target market for most financial service providers. But soon enough, they will be, and lenders should be prepared for when that happens. Gen Z, though dubbed as “millennials on steroids,” differ from millennials in a few key ways.

This article is part III of a series snapshot of Data-Driven World: Breaking Through to Generations with Better Data. Learn more about Gen X and millennials with parts I and II.

Gen Z were young when the 2008 recession hit, so they grew up with an inherent skepticism of big banks. While they share a sense of social responsibility with millennials, they do so with one foot firmly grounded in financial security. We surveyed nearly 700 American consumers to get a sense of Gen Z’s attitudes and behaviors toward lenders. Here’s what we found:

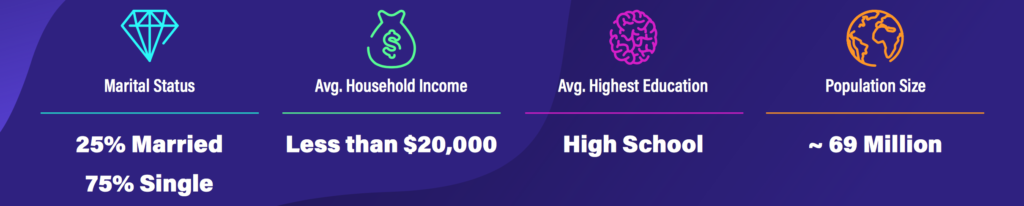

Key Attributes of Gen Z

Not only does Gen Z tend to shy away from big banks, but they’re also less tied to institutions like universities. Research shows that 64 percent of Gen Z are considering an advanced college degree, compared to 71 percent of millennials. Fully aware of the crushing student debt their older siblings and parents went through, they embody a more independent, entrepreneurial spirit. Many may bypass higher education altogether and move straight into the workforce, making them likely to start saving for retirement earlier on.

By the numbers:

- Gen Z is 55% more likely to want to start a business than millennials.

- Only 50% said they have a credit card.

- Although 39% rank mobile banking as a top service, it’s not the most important part of their banking relationship. They also value in-person interactions.

- If they dislike a new experience with their accounts, only 7% would stay with their current provider.

In line with the environment they grew up in, Gen Z are not optimistic about the future. A Business Insider survey found that 71 percent see their lives getting more challenging in the future, more than any other generation. That doesn’t mean, however, that they’re looking to banks and governments to solve all their problems. They’re self-reliant. All this to say: Lenders won’t reach Gen Z by offering to take care of everything for them; they’ll reach them by offering tools they can use to do it themselves.

And it won’t be easy to reach this generation. Their independent streak makes them unlikely to rely on any one service provider. They’ll diversify their banking assets and do plenty of research into their options, so starting a two-way conversation with them is vital. That’s where alternative data comes in handy.

Engaging Gen Z with Alternative Data

Gen Z exhibits lower credit card usage than any recent generation. According to research from TD Ameritrade, 60 percent typically prefer to pay with debit card, and only 18 percent with credit card. With such thin credit files, how can lenders and underwriters understand which consumers to reach out to?

One emerging method for enhancing risk profiles is to use social media data. But unlike millennials, Gen Z are shifting away from heavy social media use. Concerned about the future repercussions of public posts, they favor platforms like Snapchat and Instagram stories that disappear within 24 hours. As such, using social media history as a means of verifying identity or establishing credit risk will be less and less reliable.

They do, however, have plenty of data available from student loans, car loans, and mobile phone bills. And these are data points that provide an accurate picture of payment history and financial responsibility. Twenty percent of our survey respondents said they are willing to share information about their utility and telecom accounts for their credit risk profiles. This number will only increase as they get older, start to take ownership of their payments, and explore new options for credit access.

Check out ID Analytics’ case study on the predictive accuracy of alternative data for credit inclusion.

Although Gen Z have a much less robust credit history than other generations, they still have plenty of demand for access to credit. As they begin to start their own businesses, take out loans, and save for retirement, they’ll pay the most attention to the lenders that speak to their needs. Financial service providers will miss out on lucrative opportunities with this elusive generation if they don’t find a way to identify and engage creditworthy applicants in a memorable conversation.

Want to learn more about how alternative data can help to build robust risk profiles? Talk to one of our data experts today.

You may also like:

- eBook: It’s Time to Rethink Credit Scoring

- Breaking Through to Millennials with Better Data

- ID Verification for Credit Applications: How Utility Data Boosts Security & Expands Reach

If you like what you’re reading, why not subscribe?

About Amy Hou

Amy Hou is a Marketing Manager at Urjanet, overseeing content and communications. She enjoys writing about the latest industry updates in sustainability, energy efficiency, and data innovation.