Breaking Through to Millennials with Better Data

Amy Hou | January 16, 2018 | Credit & Lending

Millennials are the talk of the town these days. Banks, lenders, and service providers are paying close attention to their habits in an effort to reach the largest generation in the workforce. And, despite their alleged addiction to overpriced avocado toast, millennials can still afford to make up the largest share of home buyers. The question is, how well are financial institutions keeping up with the mercurial moods of this generation? We conducted a survey of American consumers between the ages of 18 and 40 to see how each generation compares to the others when it comes to banking habits and attitudes. This article, part II of the series, narrows in on millennials.

Catch up on part I of the series with an analysis of Gen X.

Key Attributes of Millennials

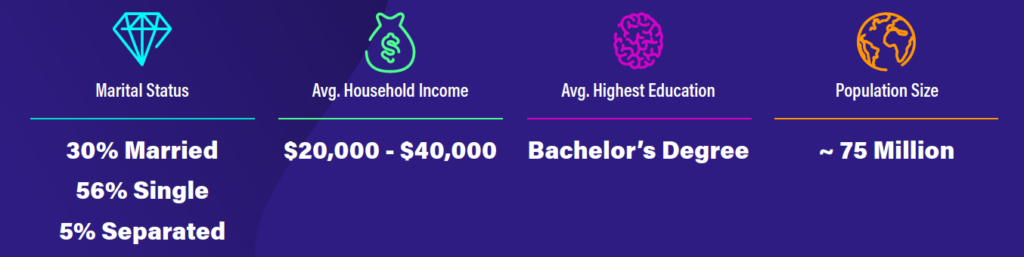

Often described as “digital natives,” millennials have grown up in a digital world. They value a quick and easy mobile experience, real-time account updates, and customized products and services. Millennials are more likely to be single and have a lower household income than their elders in Gen X. They also have fewer financial products to their name than Gen X, leaving them with less credit history.

Banking habits by the numbers:

- Less than 50% of survey respondents have 5 or more financial products

- Of the people who use a mobile banking app at least once a day, 59% are millennials

- 18% of millennials have switched primary banks within the last 12 months, compared to 10% of customers aged 35-54

- Almost twice as likely to share alternative data as Gen Z, 68% of millennials have an online account for utility bills

As a result of relatively thin credit files, millennials make up a large portion of the nation’s unbanked and underbanked consumers. This means that many go to non-traditional avenues for services like check cashing, payday loans, auto title loans, and money orders.

Because a lack of credit history limits them from a high credit score, they’re in the best position to benefit from alternative credit scoring models. These new models incorporate risk data like rent payment history, phone bill payment history, and utility bill payment history to build robust credit files.

Download the eBook to learn more about the future of alternative credit scoring.

Luckily, millennials are quite willing to share this type of data with lenders. According to our survey, they have the most widely available data on mortgage/rent, electric, and internet bills. Twelve percent more likely to share alternative data than Gen X, millennials recognize that a data-rich conversation gives them access to more and better options.

Now that there’s widespread access to alternative data, how can lenders take advantage of it to better serve millennial customers? Our survey results hint at a promising solution.

Engaging Millennials with Alternative Data

According to Paul Schaus, president of research firm CCG Catalyst, millennials want both the convenience of a digital-first experience and the personalization of a human touch. Says Schaus:

“As banks transform their business strategy to cater to this generation, they must understand that while this group wants more automated functionality, they still expect to maintain control over their banking but want human connection when they need it.”

If that sounds self-contradictory to you, that’s because it is. Like we said, millennials are mercurial. They say that they distrust banks and don’t believe they will need a bank in the future, and yet 90 percent have a relationship with a traditional bank. The key to keeping up with their mood swings is to tap into alternative data.

Out of our survey respondents, 41 percent said they find new financial products on social media, and 32 percent from marketing emails. Lenders can make use of data from mobile phone and Internet bills to figure out when consumers are most often online. Then, alternative data can help financial service providers reach millennials right when they’re browsing for new options, not before or after.

Just like anyone else, millennials want to be different from their parents. As such, they expect their banks to treat them differently than they did their parents’ generation. Only by adapting to and anticipating their needs can financial institutions hope to be competitive in a crowded industry. By tapping into alternative data points, banks and lenders can show millennials exactly why they’re needed and how they’ll help their lives improve.

Check out the full results of the survey here, and let us know what you think on Twitter.

You may also be interested in:

- Breaking Through to Gen X with Better Data

- From Underbanked to Understood: The Rise of Alternative Credit Scoring

- Video: Understanding the Credit Scoring Landscape

If you like what you’re reading, why not subscribe?

About Amy Hou

Amy Hou is a Marketing Manager at Urjanet, overseeing content and communications. She enjoys writing about the latest industry updates in sustainability, energy efficiency, and data innovation.