Breaking Through to Gen X with Better Data

Amy Hou | January 9, 2018 | Credit & Lending

More and more, banks and lenders are buying in to the digital-first trend. And for good reason — millennials are quickly growing to be the largest portion of the consumer population, and they are known for living in the digital space. Yet it’s not just millennials who are reshaping the market for financial services; their older peers are rapidly changing their behavior as well. Although often seen as more stable and mature, Gen X is still adapting to the digital age, and their banking attitudes and behaviors are adapting along with them.

In order to effectively drive customer acquisition and retention, financial service providers need to get a grasp on the differences between Gen X, born between 1965 and 1984, and other generations. To help, Urjanet conducted a survey of nearly 700 American consumers aged 18-40 and how they interact with their financial institutions. This article, part I of our series, breaks down behaviors and attitudes of Gen X.

See the full report on survey results of Gen X, millennials, and Gen Z.

Key Attributes of Gen X

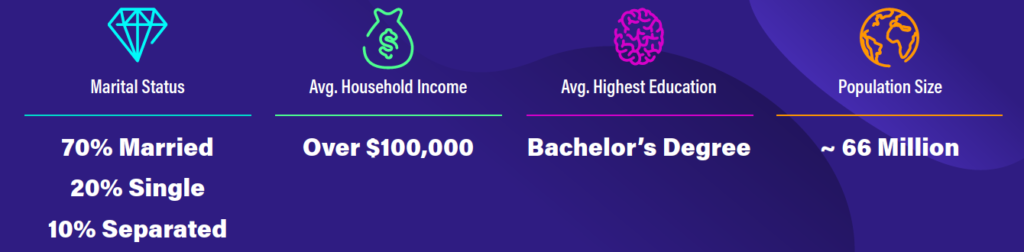

Many of the characteristics attributed to Gen X do play into the idea that this generation is stable and well-established. Seventy percent of Gen Xers surveyed are married, their average household income is over $100,000, and over half manage at least five financial products in their name.

However, there are more similarities between Gen X and their younger peers than some might expect. As one example, Gen X banks online nearly as often as millennials do. A Gallup study found that 70 percent of Gen X uses online banking services weekly, compared to 72 percent of millennials.

One area where Gen Xers stand out is their high level of debt. Perhaps unsurprisingly, given the number of financial products they typically manage, Gen X has 60 percent more debt now than someone of the same age in 2000. As such, Gen X consumers are in a prime position for refinancing opportunities.

The survey results revealed several more statistics specific to Gen X:

- 60% have at least five financial products

- Nearly 15% have more than 11 financial products

- Gen X is more willing to share basic personal information (including Social Security Number) over other types of personal data

- Only 8% would remain with their current service provider if they perceived negative account changes

- Nearly 40% are willing to share information about their utility accounts

- 71% reported having an online account for utility bills

The results suggest that Gen X is not much more loyal to their financial service providers than younger demographics. A small change in their interaction, such as a poor user experience or cumbersome process, can trigger abandonment. If banks and lenders want to secure loyalty with this segment, they have to rethink their market strategy.

So, how can financial institutions use this information to capture and retain the attention of Gen X? The answer lies in alternative data.

Engaging Gen X with Alternative Data

Alternative data goes beyond traditional financial history and into mortgage and rent payments, utility bill payment history, social media profiles, and more. Although the predictive accuracy of certain types of alternative data is still being tested, both national legislative movements and expert research are expressing growing support for its credibility.

Enriching the existing pool of data available will help lenders gain a more nuanced view of their consumers, giving them the information they need to tailor their products to specific target segments.

According to the Accenture Financial Services 2017 Global Distribution & Marketing Consumer Study:

“Banks will need to access more customer data to offer more competitive prices and faster, easier services.”

TransUnion’s recent mortgage inquiry study used data on mortgage payments to analyze consumer credit behavior. What they found surprised them. Contrary to prior expectations, rather than spending more conservatively in the month leading up to a mortgage payoff, consumers increased credit card spending by up to three times. The change in behavior was even more pronounced for those refinancing than for new mortgage applicants.

Pairing the insights from alternative data analysis with insights from generation-specific trends, lenders can get a more precise view of which products their consumers need and anticipate when they will need them. Gen X, as a demographic with the greatest potential for refinancing, can in turn receive more personalized service from their financial institutions.

As access to data is more widely available than ever, consumers are seeing the benefits of sharing their data. Taking advantage of these refined insights drives a more open and timely dialogue, benefitting lenders and borrowers alike. Alternative data, provided with consumer consent, could be the key to building more loyal and resilient relationships between consumers and their service providers.

Download the full report and join the conversation on Twitter.

You might also be interested in:

- SPARK 2017 Recap: The Infinite Possibilities of Alternative Data

- Survey: Consumers are Ready to Use Alternative Data for Credit Scoring

- Webinar: The Credit Score Present & Future

If you like what you’re reading, why not subscribe?

About Amy Hou

Amy Hou is a Marketing Manager at Urjanet, overseeing content and communications. She enjoys writing about the latest industry updates in sustainability, energy efficiency, and data innovation.