Data Showdown: How Do Alternative Data Sources Compare?

Honor Donnie | January 27, 2020 | Credit & Lending

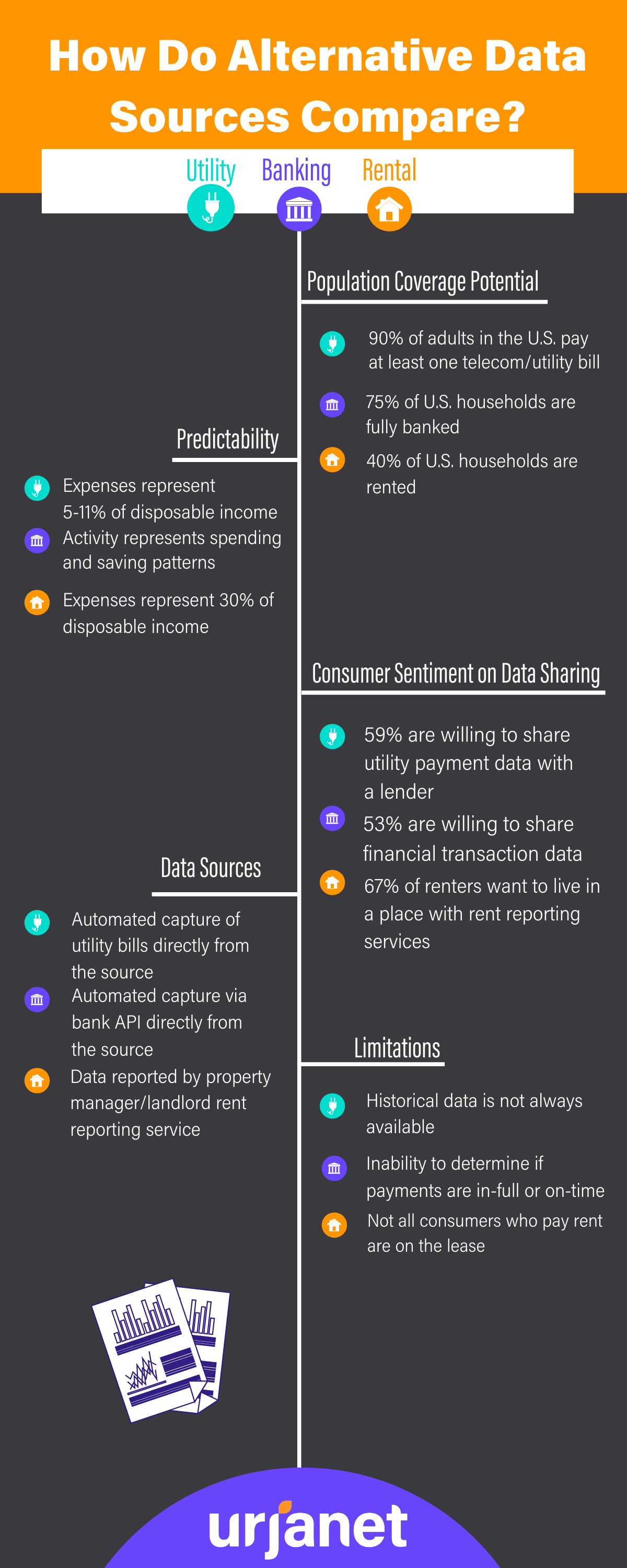

More than 91 million consumers in the U.S. have thin or no credit files. But given the current uncertainty of the economy, the financial services industry is walking a tightrope as it strives to expand credit access and grow revenue – without overextending credit. Thus, when it comes to incorporating alternative data into risk models, the type of alternative data used is critical. Here, we’ll break down a few different alternative data sources and how they stack up against each other as it relates to some specific attributes.

The breakdown: top 3 alternative data sources

Rent payments

Rental payment history is one of the most commonly utilized alternative data sources. This data is typically gleaned from bank statements, reported directly by the property manager, or provided by the renter and verified by the property manager or landlord. Rent reporting services like LevelCredit and Rental Kharma offer renters the option to report up to 24 months of rental history.

However, rent data has its limitations. Not all renters are named on the lease, preventing them from reporting their on-time payment history. Rental payments made to private landlords are also not accepted by all of the major credit bureaus. Renters sometimes withhold payment during disputes, which can result in a lapse in data or inaccurate reporting of late payment until the problem is resolved. Nonetheless, since stable, on-time renters are typically known to be more financially responsible, rental data can be a good predictor of creditworthiness.

Utility payments

Utility data is one of the most highly predictive alternative data sources. Similar to rent data, it allows for complete proof of full and timely payment, making it a reliable record for companies trying to assess creditworthiness. On average, utility payments represent approximately 10 percent of consumer income, and 90 percent of adults in the U.S. have at least one utility bill.

For consumers with little to no credit history, utility payments can help to shape their financial profiles – without exposing consumers or lenders to a higher risk of fraud. When data is collected directly from the source, there is very little opportunity for falsification. Another advantage over other alternative data sources is that utility account data does not contain or reveal much sensitive personal information.

There is also evidence that utility and telecom data can be useful for lenders. According to a PERC study, utility and telecom payment history is predictive of future credit delinquency. For consumers with severe delinquency on a utility/telecom bill, the credit card delinquency rate was 48%. Consumers with no past-due utility/telecom delinquency had a credit card delinquency rate of 4.5%.

While utility data can effectively establish and highlight non-loan payment patterns, it can sometimes be difficult to find sufficient historical data. Utilities do not always provide more than 12 months of history. Billing formats can also vary greatly across utility service providers. To combat this, data service providers like Urjanet aggregate utility data and put it into a format that credit building services, credit bureaus, and lenders can use.

Contact us to learn more about Urjanet’s utility data aggregation services.

Bank statements

How many people do you know with an active bank account? Especially given Gen Z’s tendency to spend with debit cards rather than credit cards, bank accounts hold a wealth of payment information. Whether it’s a cell phone bill or a monthly Spotify subscription, bank statements have a unique ability to show payment patterns that are otherwise overlooked.

Banking data provides a comprehensive view of spending and saving behavior. Particularly when the data is pulled directly from the source via API, bank statements are also verified and credible. UltraFICO, for instance, uses information from checking, savings, and money market accounts to supplement data already in one’s credit report. With this data, lenders can see how much a consumer has in savings, how long the accounts have been open, and how actively they’re used.

However, bank statements cannot provide context to reveal whether payments were made in full or on time. Some service providers are also difficult to identify on bank statements, obscuring which account type a given charge is related to. Ultimately, banking data can only show positive payment history, so some lenders may consider it less reliable than other alternative data sources.

Find your match

So, which alternative data source is right for you? The answer is, most likely, more than one. Each of the alternative data sources mentioned have their own advantages and disadvantages. While each data source can tell a different story, only together do they complete the puzzle of a credit invisible consumer’s true creditworthiness.

YOU MIGHT ALSO BE INTERESTED IN:

- Survey: Consumer Sentiments on Alternative Data Sharing

- Alternative Data: A Risk Management or Revenue Tool?

- 3 Ways to Assess Credit Risk with Utility Payment Data

If you like what you’re reading, why not subscribe?

About Honor Donnie

Honor Donnie is a Marketing Coordinator at Urjanet, with a passion for content creation. When she’s not at Urjanet, she can be found reading, cooking, and listening to great music.