A Comprehensive Guide to Alternative Data Sources

Amy Hou | December 28, 2018 | Credit & Lending

There’s no question that the U.S. is in need of more expansive credit scoring models. The Consumer Financial Protection Bureau (CFPB) estimates that 45 million Americans struggle to get a loan because of insufficient credit history. To date, a number of promising solutions have already come out of the woodwork to address the gap. But, out of the growing multitude of alternative data sources, how can lenders sift through the noise and find the right types of alternative credit data to use?

Credit scores & data: a powerful combination

To start off, let’s walk through how alternative data sources fit into the credit model. A credit bureau will use a credit scoring model to evaluate one’s worthiness to receive credit. Creditworthiness is calculated by a three-digit number that translates a person’s credit payment patterns. This notorious number predicts the likelihood that the consumer or small business will repay their debt. Simply, the higher the number, the better the terms of the loan.

The FICO scoring model is the most common and trusted model, relying on the following data sources: payment history, credit utilization, credit history, types of credit, and new credit. This model is perfect for consumers with a long, extensive history of credit – but what about those who don’t have the track record?

It’s like being a 16 year old who’s looking for their first job. In order to score a job, you need experience – but to get experience you first need to get hired. Without a credit history, a consumer can’t qualify for a loan to purchase a car or buy a house. The CFPB found that one in ten adults have zero credit history with any of the big three credit bureaus. For these consumers, even obtaining a credit card is difficult: there’s zero proof of payment behavior, resulting in very weak chances of getting approved. Consumers who are stuck in these sticky situations are classified as the “credit invisible.”

Check out our eBook to learn how alternative data channels are revolutionizing the credit industry.

Fortunately, times have changed, and lenders now have a plethora of new options to qualify credit invisible consumers. A number of unconventional sources of data can now be used to bolster traditional credit risk models – this is what we call alternative credit data. With this, lenders can safely extend credit to an entirely new customer base, and consumers and small businesses can get access to the credit they need.

Now, that’s not to say that all types of alternative credit data are weighed equally. While each has its pros and cons, a few stand out as clear winners in the categories of predictive accuracy, reliability, and access. So without further ado, we present: The definitive guide to alternative data sources for credit risk decisioning.

Retailer & purchase data

Retailers collect a substantial amount of behavioral data that can provide meaningful insights for credit risk. Purchases of diapers or school supplies on a loyalty card, for example, would reasonably indicate a certain family income and structure. However, access to this type of data is hard to come by. Retailers typically will not sell point-of-service data to lenders or credit bureaus.

For that reason, purchase data is likely better suited for marketing purposes than for credit scoring. Platforms like Cardlytics aggregate anonymized purchase data for retailers, identifying potential customers through banking transactions, browser cookies, and device IDs. With this data, marketers can easily create targeted digital ads, all without collecting personally identifiable information (PII). Access to anonymous purchase data for marketing is promising; access to individual data for credit scoring is less so.

Social media profiles

Social media profiles also contain a wealth of publicly available information on consumer behavior. On the one hand, a lender could view an individual’s LinkedIn profile to assess employment history and professional connections. Facebook and Instagram profiles can reveal lifestyle choices and spending habits. On the other hand, social media history can still be fabricated; it’s not easily verified or directly predictive of credit risk.

Moreover, younger demographics like Generation Z are shifting away from heavy social media use. Aware of potential consequences of public posts, they prefer ephemeral platforms like Snapchat that don’t leave a lasting history. That’s why using social media profiles as a means of establishing credit risk will be less and less valuable over time.

In this case, the data collected needs to have enough pertinent details about the consumer in order to provide them with an alternative credit score. “Anonymised” charges don’t result in the thorough data that a lender is looking for.

Psychometrics

Think of psychometrics as an old-school method in a modern context. Lenders scoping for potential borrowers can filter out riskier customers using surveys and questionnaires. These vary dramatically in composition, but all contain similar questions to weigh an applicant’s financial literacy and reliability.

Especially compared to other types of alternative credit data, psychometrics require relatively intense participation on behalf of the consumer. People applying for credit have to complete assessments that test them on qualitative and quantitative skills. Their scores are based on questionnaire answers as well as spending habits, personalities, and behavioral patterns. As a result, psychometrics can harbor built-in biases.

It’s important to note that the credit invisible might be between a rock and a hard place with this data source. Variables that may have negatively affected them in a standard loan process tend to be positively correlated with the results of these questionnaires, such as a basic understanding of finance.

Short-term loan data

Utilizing short-term loan data as an alternative data source is promising for one obvious reason: it’s proof that the consumer will most likely repay their loans if they have done so in the past. Short-term loans or cash advance loans usually require the borrower to have a checking account. Naturally, higher rates of interest are the downside to these types of loans, but the upside is giving borrowers proof of a reliable income stream.

For credit invisible consumers who may not otherwise have a credit history, showing that they never miss payments made with cash can be seen as a good alternative, as long as receipts or other forms of documentation can be provided to substantiate payments.

Of course, this method can turn into a double-edged sword if consumers have reliably repaid their short-term loans. It could potentially damage their credit score rather than helping.

Banking data

Bank account data is one of the most accurate and timely types of alternative credit data. When lenders and credit bureaus have access to a consumer or business’ bank statements, they can see every credit and debit activity for those accounts. And, unlike traditional credit reports that are pulled once every 30 days, bank statement data is up-to-date, to the minute that it’s retrieved.

Platforms like Yodlee, Plaid, and Finicity have mastered the secure transfer of bank data to lenders and credit reporting agencies. Many offer consumer-permissioned access channels, allowing consumers to be fully in control of their data while meeting lender requirements for FCRA compliance. Users simply link their bank accounts via their login credentials, and they can opt-in to share banking data for credit decisions.

Some consumers may be wary of providing lenders with access to their banking data, as bank accounts contain sensitive information that would have substantial financial impact on consumers if breached. Bank statements can also leave out important context. You may be able to tell, for example, that someone pays their electric bill on the same day every month, which is a good sign. But you can’t tell if they’re paying the full amount that they owe, or even if they’re paying on time (they could just be consistently late).

Rent payments

According to the Center for Financial Services Innovation, rental payments are among the most reliable alternative data sources. Monthly rent payments reveal a reliable history of consistent behavior and fiscal responsibility. There’s an abundance of rent data available: over 60 percent of people under the age of 35 are renters, and rent is the largest monthly expense for most households.

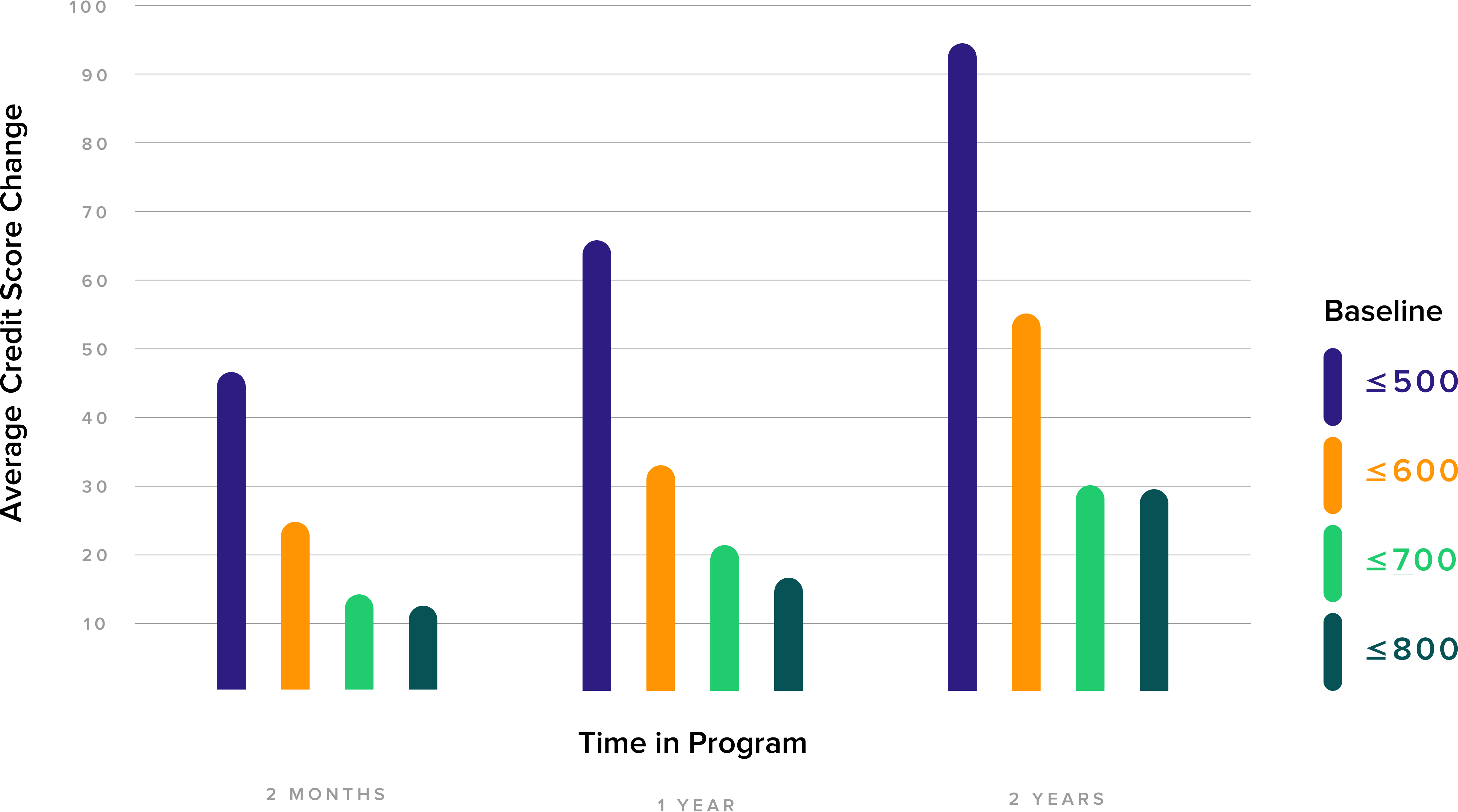

Rent payments can also directly impact consumer credit scores. Tenants simply connect their rent payments to their credit files using a service like LevelCredit, and their positive rent payment history will be reported to the major credit bureaus. In a study of more than 36,000 LevelCredit users, consumers saw their credit scores increase by an average of 20 points in just two months and 50 points after two years.

Source: LevelCredit

Utility & telecom data

Telecom companies hold copious amounts of relevant data, but some of its use cases are still experimental. Some have proposed using real-time mobile phone data to capture an individual’s location and verify their work and home addresses, thereby determining stability.

Even more accurate of a source is the phone bill itself. A mobile phone bill contains the following data points:

- Full name

- Billing address

- Due date

- Actual payment date

- Amount due

- Actual amount paid

Taken together, these data points reveal a customer’s overall payment history, and not only whether they pay on time every month, but whether they’re paying the full amount they owe.

Utility bills – including electric, water, natural gas, waste, and cable – offer the same data points. These types of alternative credit data show a sound monthly history of payment patterns, and when combined with rent payments, represent more than 25 percent of consumer spend.

The Center for Financial Services Innovation report put utility bill payments on par with rent payments, when it comes to predictive accuracy. However, positive history of utility payment data has not typically been reported to credit bureaus. According to FICO, today only about 2.4 percent of consumer files currently include utility data.

New ways to access alternative data sources

More and more lenders are keying in to the notion that utility and telecom histories are valuable alternative data sources. Experian and Finicity recently launched a new program, Experian Boost, that enables consumers to add utility and phone payments to their credit reports through permissioned access to their bank accounts.

While in theory this enables utility payment history to be considered for credit risk, there’s another way to retrieve utility and phone payment data that also includes payment timeliness and completeness – and that’s from the utilities themselves. Urjanet’s Utility Data Platform leverages existing integrations with over 6,500 utility and telecom providers to streamline and deliver accurate phone and utility payment data directly from the source.

Direct access to utility and telecom payment data can enable lenders to uncover new revenue within their decline traffic, and safely expand credit access to millions of consumers.

With Urjanet’s user-permissioned model, lenders and credit reporting agencies can tap into new alternative data sources with confidence that the data they’re relying on is accurate and compliant. Direct access to utility and telecom payment data can enable lenders to uncover new revenue within their decline traffic, and safely expand credit access to millions of consumers.

The race for the right types of alternative credit data

The credit industry is fully aware of the lending gap it needs to close. Fortunately, lenders and credit reporting agencies have begun to seek various types of alternative credit data – just in time. While the near-prime consumer population is growing, only a finite portion are high-quality applicants. Lenders that tap into the right alternative data sources first will gain a vital advantage in reaching and successfully serving this market.

Interested in learning more about accessing utility and telecom payment data from Urjanet? Request a demo today.

You may also like:

- Survey: Consumers Are Ready to Use Alternative Data for Credit Scoring

- New Credit Risk Models for the Unbanked Emerge

- 3 Ways to Assess Credit Risk with Utility Payment Data

If you like what you’re reading, why not subscribe?

About Amy Hou

Amy Hou is a Marketing Manager at Urjanet, overseeing content and communications. She enjoys writing about the latest industry updates in sustainability, energy efficiency, and data innovation.