3 Reasons for Lenders to Give Decline Traffic a Second Chance

Amy Hou | July 26, 2019 | Credit & Lending

Over the last decade, alternative lending has gone mainstream, significantly shifting the landscape for consumer and small business loans. Where a loan was once a slow-moving manual review of credit criteria, alternative lending platforms now use big data to automate most of the underwriting process and provide rapid credit decisions. However, even with these changes, one thing has stayed constant: the rejection of decline traffic.

Despite the fact that there are more ways than ever to evaluate a consumer’s stability, ability, and willingness to pay back a loan, most lenders are still rejecting the majority of their loan applications as they rely on traditional credit scoring methods. According to Experian’s 2019 lender survey on alternative credit data, 66 percent of lenders decline more than five percent of applicants due to insufficient credit history.

The industry is still searching for an ideal solution to properly identify risk, as the traditional credit scoring model doesn’t shed light on all consumers. But while it may be too late to change the credit decisions that have already been made, it’s not too late to open the door to decline traffic and give qualified applicants a second chance.

1. Give consumers needed access to credit

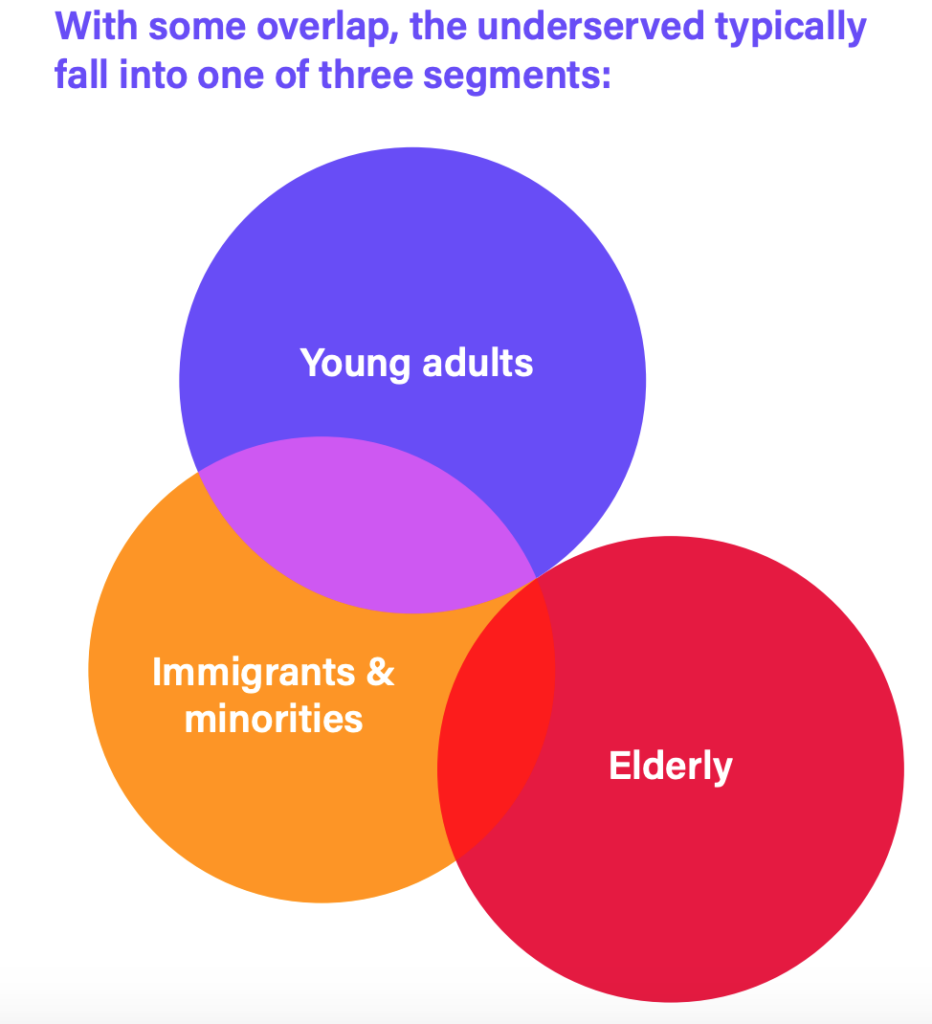

Currently, nearly 50 million consumers and 160 million small businesses are credit invisible or credit unscorable in the U.S., which makes it nearly impossible for them to build up enough credit for loan consideration. It’s not that these populations have never attempted to build their credit files; they’ve simply lacked the proper resources.

For example, these individuals might include students who just graduated college but have yet to build up enough credit, an immigrant with a positive credit history in her home country but no visibility in the U.S., or a newly divorced single parent with no independent credit history. Until recently, lenders have had little to no choice but to reject these individuals, for lack of better information. But times have changed, and it’s time for the treatment of decline traffic to change, too.

Alternative data has proven to accurately score more than 90 percent of applicants who otherwise would be returned as a no-hit or thin-file by traditional scoring models. Not only would it enhance visibility into their credit history, but it would in many cases boost their credit scores. Alternative credit scoring could help approximately 7.6 million consumers who are currently unscorable to earn a credit score of 620 or higher.

2. Increase revenue for lenders

Decline traffic represents a massive missed opportunity for lenders. They’ve already spent a substantial budget on acquiring these applicants through marketing and sales efforts, only to turn them away at the end. New data sources and new credit scoring models enable lenders to take a portion of this lost revenue back.

The buildup of decline traffic from loan applications is standing in the way of industry growth, and of immense revenue potential for individual lenders. According to the World Bank, taking advantage of alternative credit data could expand formal financial services to up to a staggering 100 million more adults globally. These new transactions translate to approximately $380 billion in new revenues for banks and lenders alone.

3. Take advantage of existing data sources

Another reason to revisit decline traffic? It’s easier now than ever before. More and more types of alternative credit data are available each day, and they’re proving their worth. No one is advocating for a reckless expansion of lending to completely unknown applicants: the use of alternative data sources like rental payment history and utility payment data provides a reliable record on which to predict future payment behavior.

Both traditional credit bureaus and online lenders are starting to use alternative data in their decisioning. Credit scores like VantageScore and FICO XD have incorporated some alternative data, as well as permission-based tools like Experian Boost. Lenders can also access user-permissioned utility payment data from Urjanet, pulled directly from utility providers for recency and accuracy.

Of course, nothing ever runs completely seamlessly, and alternative credit scores do have their flaws. But depending on the type of data used, the pros far outweigh the cons. With the right sources of alternative data, lenders can help these populations of unbanked and underbanked candidates gain access to the credit they need, and drive more revenue along the way. Everyone deserves a second chance, and lenders today are poised to give their decline traffic that chance with confidence.

To learn more about how utility payment data works in action to enhance visibility into decline traffic, check out our report.

Related Resources:

- Alternative Data: A Risk Management or Revenue Tool?

- 3 Ways to Assess Credit Risk with Utility Payment Data

- Top Alternative Credit Scoring Companies to Watch in 2019

If you like what you’re reading, why not subscribe?

About Amy Hou

Amy Hou is a Marketing Manager at Urjanet, overseeing content and communications. She enjoys writing about the latest industry updates in sustainability, energy efficiency, and data innovation.