Boost Two-Wheeler Sales in India with Alternative Data

Ayan Kumar | July 12, 2021 | Credit & Lending

The Asian Pacific market has remained one of the most critical regions for the two and three-wheeler industry for years. Between rising urbanization and a flawed public transportation system, using two and three-wheelers for personal and business activities have fueled the industry’s growth. With India ranked as the largest two-wheeler consumer market, it’s poised to become an industry driver. To increase the accessibility of financing and increase two-wheeler sales, banks and lenders can turn to alternative data to provide additional insight into credit decisioning for borrowers.

The impact of COVID-19 on the automobile industry

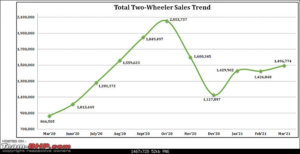

The last two years have been very erratic in terms of demand, where two-wheeler sales decreased globally by 14 percent but managed to recover midway through 2020. However, after India experienced another wave of COVID-19, the automobile sector took a hit, resulting in a decline of 66 percent in commercial vehicle sales, 76 percent in three-wheeler sales, and 55 percent across the automobile sector. Though the numbers look grim, if past cyclicity of sales data is to be trusted, the sales number for individual mobility vehicles is expected to boom.

The pandemic led to a decline of 66 percent in commercial vehicle sales, 76 percent in three-wheeler sales, and 55 percent across the automobile sector.

Indian manufacturers are the volume producers for the world’s low and mid-cubic capacity motorcycle production. The growth to become the world’s largest manufacturer comes from the growing domestic market, partnership with European and Japanese manufacturers, and highly competitive pricing. The Indian government’s decision to increase subsidy on electric two-wheelers by 50 percent under FAME II subsidy will encourage adoption and help match prices of electric two-wheelers with that of internal combustion engines.

An opportunity for growth

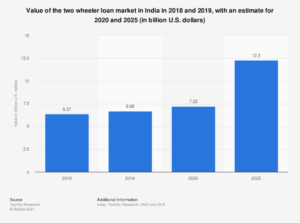

The two-wheeler loan market in India is expected to grow at a CAGR of 11% over the next 5 years and is expected to cross $12.3 billion.

India’s two-wheeler loan market was $6.37B in 2018 and $7.22B in 2020 despite a slump in sales figures. This could be related to the increasing number of premium motorbike sales. Or is it? The recent economic woes can not be neglected in the dream of a rich future. Poor purchasing power and increased loan volume call for better background checks. While most financers would not like to miss out on the opportunity of a forecasted $12.3B loan market by 2025 just for the two-wheeler segment, there is a need for revised measures of checks and balances for sustainable growth.

Support two-wheeler sales with alternative data

Two-wheelers are often the first consumer good that an earning Indian consumer purchases after a smartphone as well as the first good where they spend upwards of $1200. Such consumers typically have little to no credit history, and loan qualification and identity verification are cumbersome tasks. An alternative data source could be a valuable input in understanding such customers’ spending habits and repayment patterns for prospective lenders.

Urjanet provides consumer permissioned utility data from thousands of utility and telecom providers. This can be used to augment creditworthiness models for both consumers and small businesses. To learn how direct and automated access to alternative data can support credit risk decisioning, contact our utility data experts today.

If you like what you’re reading, why not subscribe?

About Ayan Kumar

Ayan is an Assistant Manager at Urjanet, assisting with content development, GTM strategy development, and execution. When he is not working, he enjoys reading about tech, playing cards, board games, and traveling.