Risky Business, Pt. II: Intelligent Automation for ID Verification

Amy Hou | August 14, 2018 | ID Verification

Who are you, really? That’s the question financial services companies are asking their customers. This, of course, is nothing new: furnishing property records, government IDs, and other proof-of-identity documents has long been a staple risk reduction tactic in fraud-prone transactions. What is new, is how intelligent automation and automated identity verification technologies are revolutionizing the way identity is proven. These new technologies are enabling firms of all sizes to mitigate risk and ensure compliance without breaking the bank — or scaring away users.

This post is part two of our series, Risky Business, in which we’re examining how emerging automated solutions are helping businesses to mitigate risk while improving efficiency and user experience (click here to read part one: Intelligent Automation for Credit and Lending). Today’s post will explore intelligent automation for identity verification in finance. Along the way, we’ll consider how utility data can help power emerging ID verification solutions.

Automated Identity Verification in the Financial Sector

Many industries depend on reliable identity verification, but the financial sector may find it more important than most. Anti money-laundering (AML) statutes, including so-called “Know Your Customer” and “Know Your Business” (KYC/KYB) regulations, mandate that banks and lenders maintain accurate identifying records on their customers. The core purpose of this legislation – enacted in part at the start of the Nixon administration’s War on Drugs and reinforced in the wake of the September 11th, 2001 attacks – is to prevent cash from flowing to or from terrorist groups or hostile governments through U.S. banks.

The measures mandated by AML regulations include:

- Maintaining a thorough Customer Identification Program (CIP)

- Matching customer names against lists released by federal and international law enforcement agencies (aka “name matching”)

- Statistical predictions of a customer’s expected behavior and suspected risk of committing a financial crime

Ongoing comparison of customers’ actual behavior, compared to their risk profile and the behavior of similar customers - The Cost of Compliance

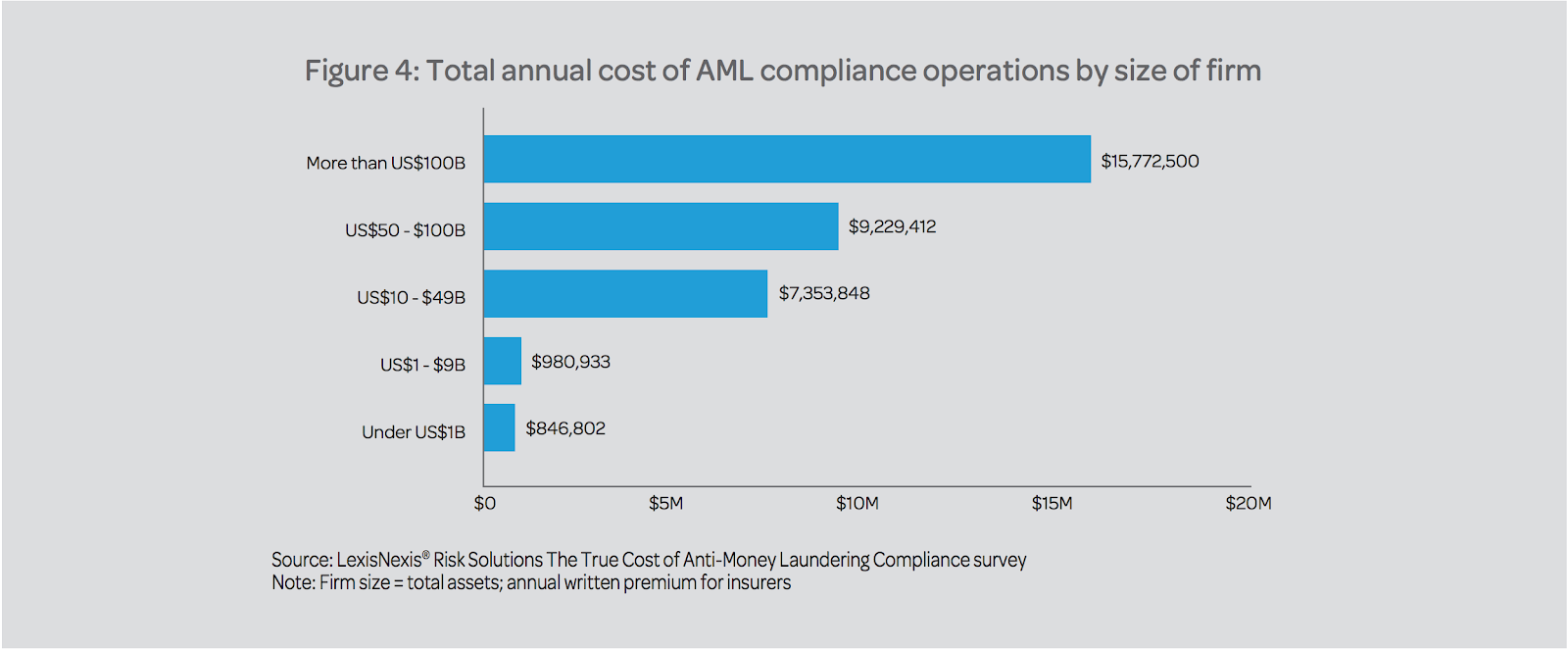

Satisfying these requirements can cost financial firms a lot of money. Dollar values are difficult to estimate, but a 2016 LexisNexis white paper examining Asian banks puts AML compliance costs for small firms (with fewer than $1 billion in total assets) at almost $1 million annually. For the largest lenders (with greater than $100 billion in assets) that figure soars to nearly $16 million per year.

“Global banks’ misconduct costs have now reached over $320 billion – capital that could otherwise have supported up to $5 trillion of lending to households and businesses.”

These costs aren’t only operational. Failure to properly comply with AML regulations can invite hefty fines. As Mark Carney, Governor of the Bank of England, noted in his remarks at the Institute of International Finance’s 2017 Washington Policy Summit: “Global banks’ misconduct costs have now reached over $320 billion – capital that could otherwise have supported up to $5 trillion of lending to households and businesses. But there is a bigger cost. An industry the scale and importance of finance needs social capital as well as economic capital. It requires the consent of society in order to operate, innovate and grow.”

The Benefits of Intelligent Automation

Trustworthy, automated identity verification solutions can generate both social and economic capital. By reducing friction in the user experience, they can help generate revenue and inspire brand loyalty. By improving AML compliance, they can reassure investors and help avert regulatory fines. Conveniently, a new generation of electronic identity verification (eIDV) solutions is emerging to meet this precisely this need.

Regulatory technology, or regtech, firms like IdentityMindGlobal and Trulioo are bringing intelligent automation to identity verification. These and other similar compliance-focused eIDV firms advertise secure, automated identity verification and corroboration that outdoes traditional document-based identification methods both in terms of speed and reliability.

“For years, static personally identifiable information was the key to identity proofing, but given the availability of stolen identities, this can no longer be the case.”

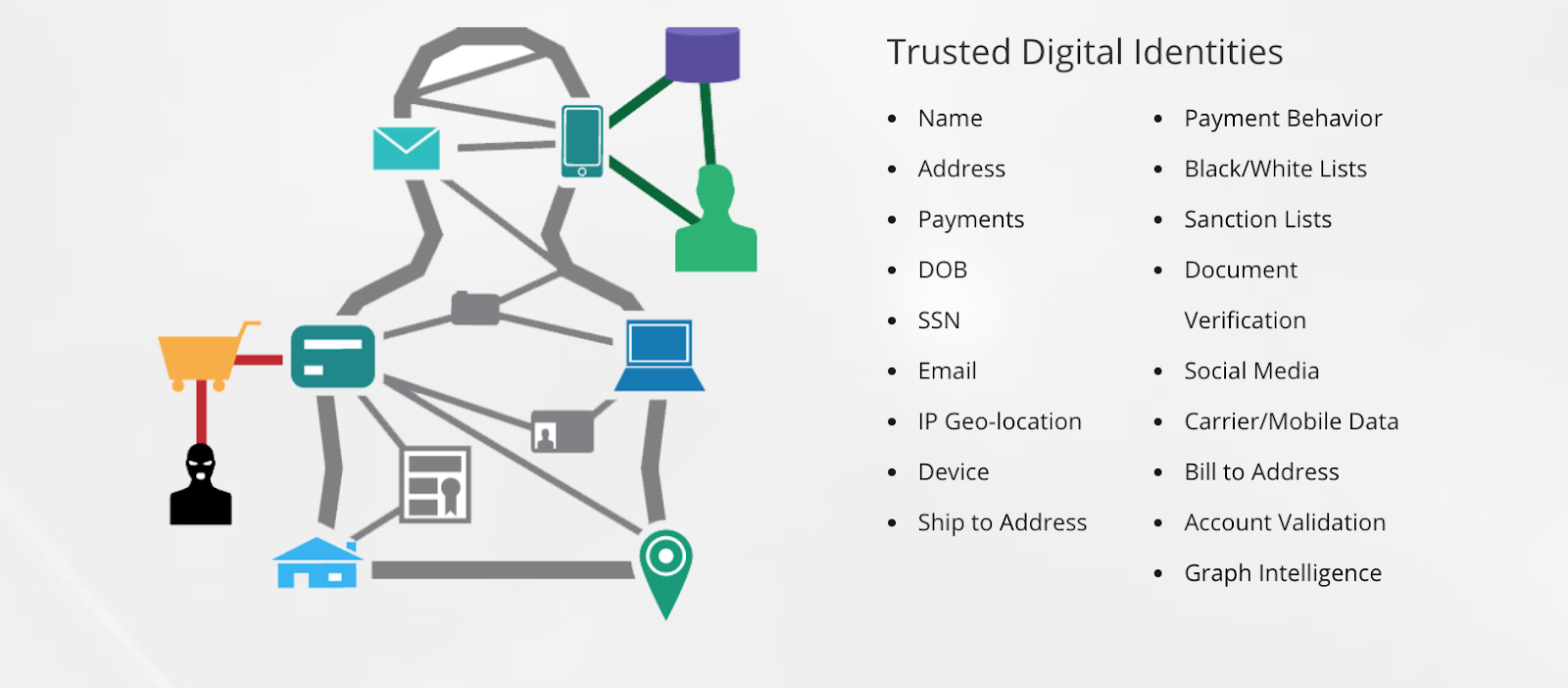

Automated identity verification solutions allow new or returning users of financial services to link multiple, independent sources of identifying information – from social media accounts to government-issued ID – and digitally synthesize this information to generate a “corroborated” identity. This process reduces the human overhead necessary to conduct identity verification while still improving security. Humans make mistakes: computers, less so.

Ben Canner of Identity Management Solutions Review wrote: “For years, static personally identifiable information was the key to identity proofing, but given the availability of stolen identities, this can no longer be the case. Further,” he notes, citing Gartner’s 2018 Market Guide for Identity Proofing and Corroboration, “enterprise attempts to use deeper personal information to verify customers often led to false positives—even the legitimate customers didn’t know the answer—and a higher rate of customer abandonment.”

In short: the technology we need to replace outdated, paper ID verification methods with intelligent automation is here. And Urjanet is ready to help.

Utility Data for Identity Verification

Automated utility data is the next piece of the eIDV puzzle. Organizations from DMVs to banks have long used paper utility bills as a reliable proof of residence. New, automated digital identity solutions can now use the same data, electronically and on demand. Trusted data providers like Urjanet can retrieve and supply users’ utility bill information – including name, address, payment history, and more – on behalf of eIDV regtech firms, who in turn verify a user’s identity on behalf of their financial sector clients.

All of this can happen in minutes, as opposed to the insecure, inefficient manual data collection and review still practiced by some banks and lenders. And lenders can trust that an applicant is who they claim to be, without exposing themselves to the liability of handling sensitive, personal information.

The era of intelligent automation for identity verification has arrived. What might it mean for your business? Check out our solutions sheet to learn more. And if you’re ready to see what utility data can do for your identity verification process, contact us today.

Related Resources:

- Webinar Recap: Secure ID Verification in a Digital World

- Solidifying Digital Identity in the Sharing Economy

- Risky Business, Pt. I: Intelligent Automation for Credit and Lending

If you like what you’re reading, why not subscribe?

About Amy Hou

Amy Hou is a Marketing Manager at Urjanet, overseeing content and communications. She enjoys writing about the latest industry updates in sustainability, energy efficiency, and data innovation.

You May Also Like

Overcome Customer Onboarding Challenges in the Financial Sector

Honor Donnie | December 16, 2021 | Data & Technology | ID Verification