Risky Business, Pt. I: Intelligent Automation for Credit and Lending

Amy Hou | August 7, 2018 | Credit & Lending

Intelligent automation is changing how companies do business.

The impact is bigger than you might expect: CapGemini’s recent report estimates that intelligent automation technology could add $512 billion of economic activity to the worldwide financial sector in the next 18 months. Emerging automated financial systems, from marketing communications to intelligent anti-money laundering (AML) and anti-fraud checks, are simplifying traditionally labor-intensive tasks. The result? Fintech startups and full-service investment banks alike are cutting costs, improving customer satisfaction, and growing revenue.

Today’s blog post is part one of a two-part series dedicated to exploring the many ways that intelligent automation is helping businesses overcome risk assessment hurdles and drive revenue growth. In part one, we’ll explore the automated financial systems that are changing the credit and lending landscape. Along the way, we’ll examine the role that utility data can play in the bigger picture of financial automation, and how reliable utility data can help lenders grow revenue and serve new markets.

Replacing Humans with Robots

CapGemini identifies three key classes of financial automation: robotic process automation (RPA), artificial intelligence (AI), and business process optimization (BPO).

These classes of intelligent automation encompass the solutions financial firms are increasingly adopting to engage with customers, streamline rote business tasks, and reduce overhead (yes, including replacing humans with robots).

The range of credit and lending applications for these solutions is vast: the financial sector is ripe for automation, and companies are already rolling out solutions from marketing and customer support to AML and fraud prevention.

The Customer Experience: From ATMs to Chatbots

Let’s begin on the customer-facing side of the automation equation. Consider first that banks have never shied away from putting tech on the front lines of customer interaction. Automated Teller Machines (ATMs) have been managing transactions since Chemical Bank unveiled the original punch card-powered model in 1969. Today, 98.5 percent of all banking transactions are done electronically, either by ATM or online, and – as the Washington Post’s Thomas Heath suggests – bank tellers may be going the way of the blacksmith.

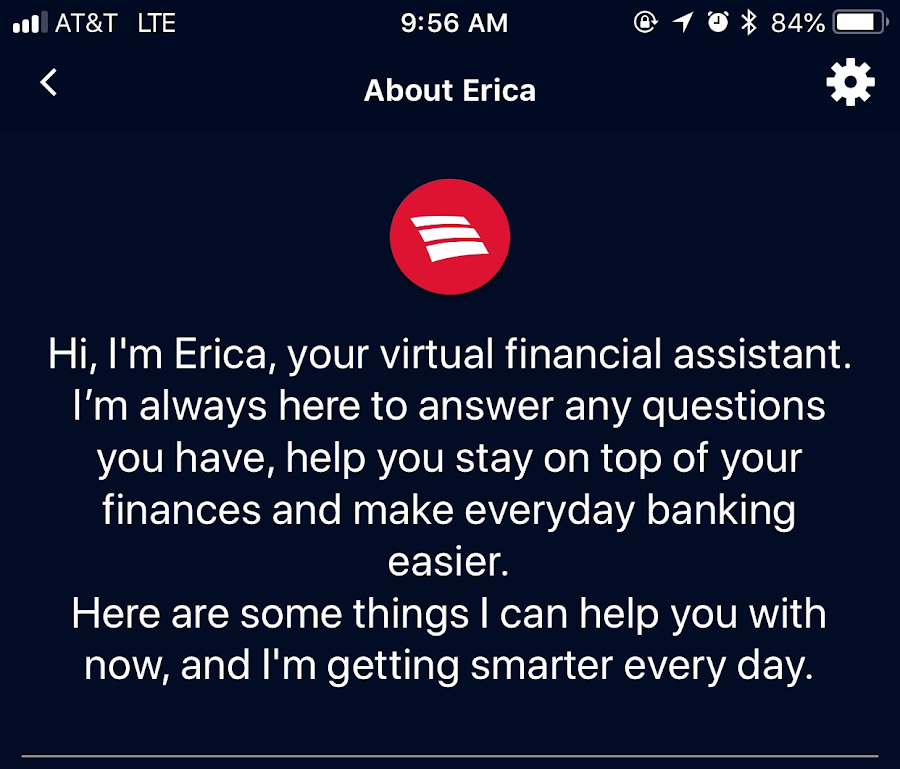

The trend is only accelerating. This March, Bank of America unveiled its new robotic assistant, Erica, to surprisingly good reviews and widespread adoption. One million users have begun regularly using Erica to help them bank in the first three months since the service launched.

Automated UX advancements like Erica aren’t just potential cost-cutters; they’re also popular with customers. CapGemini’s report finds that 64 percent of surveyed financial firms have seen sharp improvements in customer satisfaction when using intelligent automation to streamline the customer experience. And, really, that’s not so surprising: would you rather verbally ask a question and receive a quick, relevant answer, or spend 10 minutes navigating through a maze of menus?

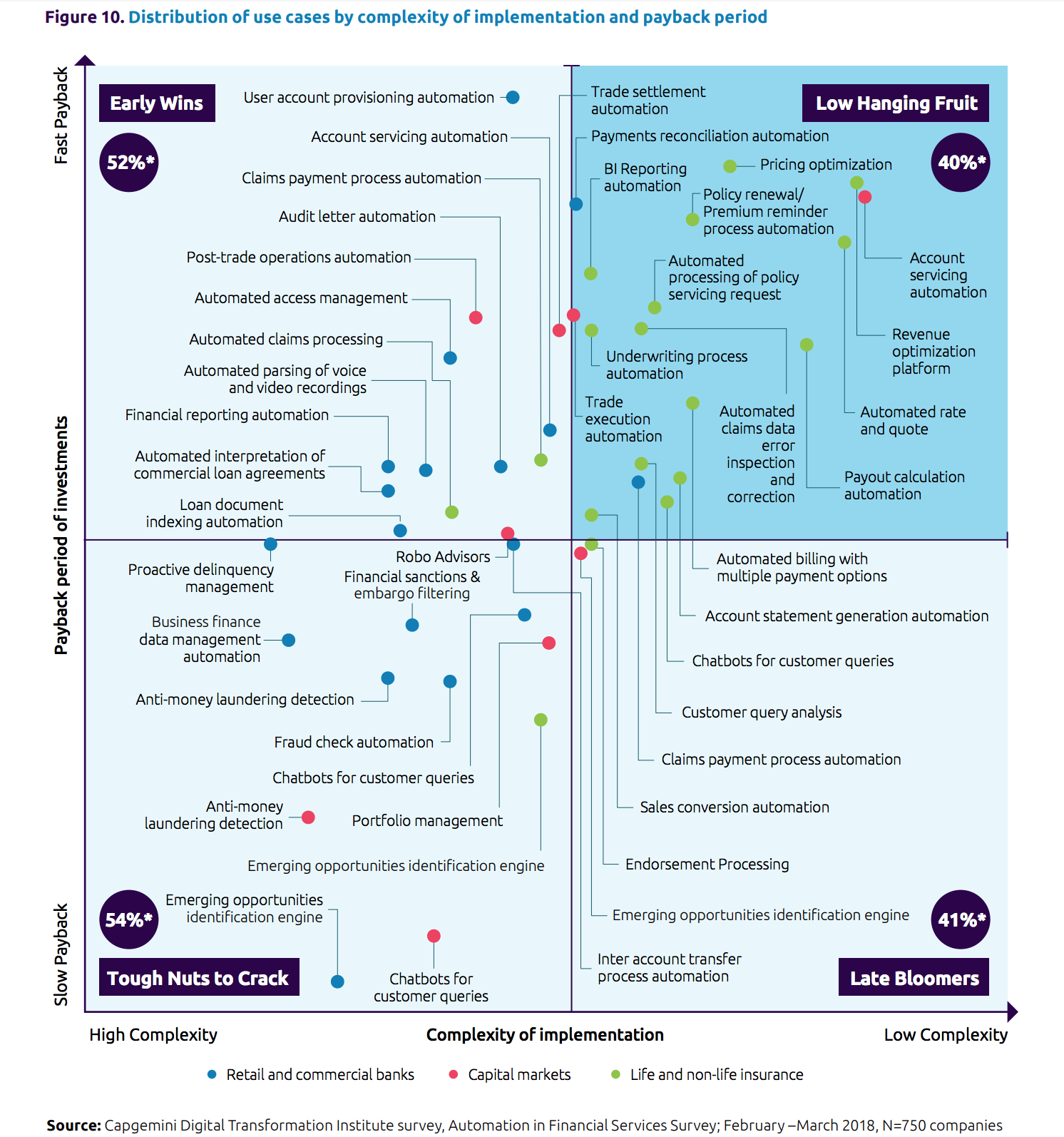

Not all automated solutions are so easy to implement well. CapGemini puts chatbots like Erica in the “low-hanging fruit” category of automated financial systems, defined by relatively low complexity of implementation and rapid payoff for firms. Simple tools like automated rate and quote calculators, and automated account portals, also fall into this category. More complex solutions – AML and anti-fraud systems, as well as portfolio management – fall into the opposite category: “tough nuts to crack.”

Robotic Risk Management

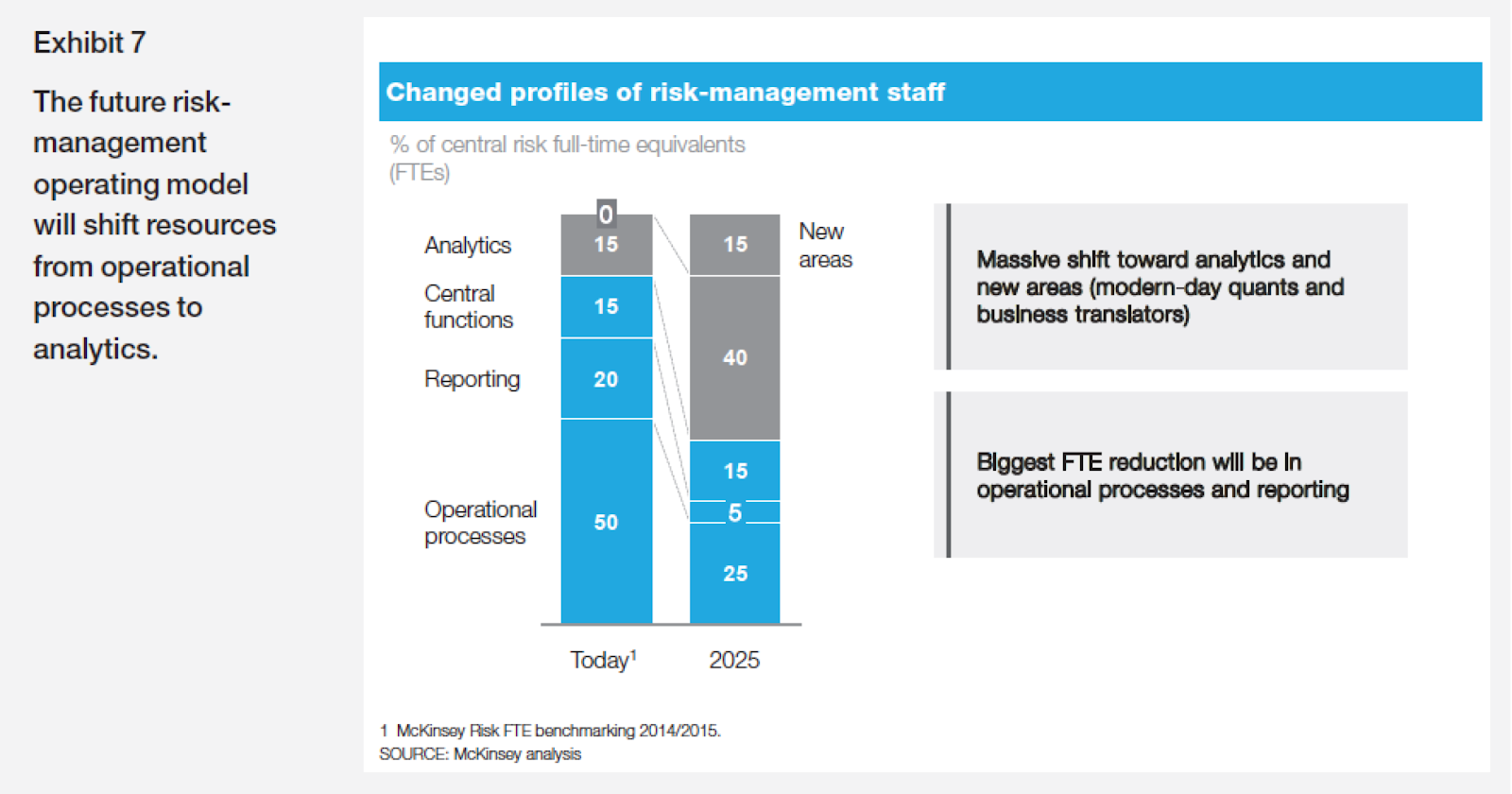

These “tough nuts” largely involve financial risk – especially fraud risk and AML compliance. When it comes to managing financial risk, often-repetitive operational tasks dominate the workload. A typical bank’s risk management function devotes approximately 50 percent of its staff to operational processes, compared with 15 percent for analytics. The payoff of automation in financial risk assessment is fairly clear: there’s a huge opportunity to reduce the human overhead devoted to repetitive operational financial risk assessment. But the stakes are high: falling afoul of regulations or creating fraud vulnerabilities can cost banks billions.

Nevertheless, McKinsey estimates that by 2025 the operational and analytics segments of risk management will shift to 25 percent and 40 percent of banks’ risk workforces, respectively. Why? In large part, fintechs.

Emerging fintech startups, as McKinsey notes, “do not want to be banks, but they do want to take over the direct customer relationship and tap into the most lucrative part of the value chain—origination and sales.” These new customer contact points, where the need for solid financial risk assessment is greatest, are also the most lucrative: in 2014, they accounted for 60 percent of banks’ revenue. Fintechs that can successfully capture just a sliver of this revenue stand to make billions.

They’re well positioned to do so, precisely because they don’t want to be banks. By automating traditionally human capital-intensive risk management operations like evaluating credit risk and detecting fraudulent borrower behavior, fintechs such as ThreatMatrix – acquired by LexisNexis parent RELX for $815 million earlier this year – can take over key aspects of risk management in origination and sales. This spares banks the operational headache of managing risk while also streamlining the user experience, helping to cut costs and grow revenue all while improving customer satisfaction.

Click here to learn how one alternative credit bureau expanded into new markets with automated utility data.

Intelligent Automation Pays Off for Online Lending

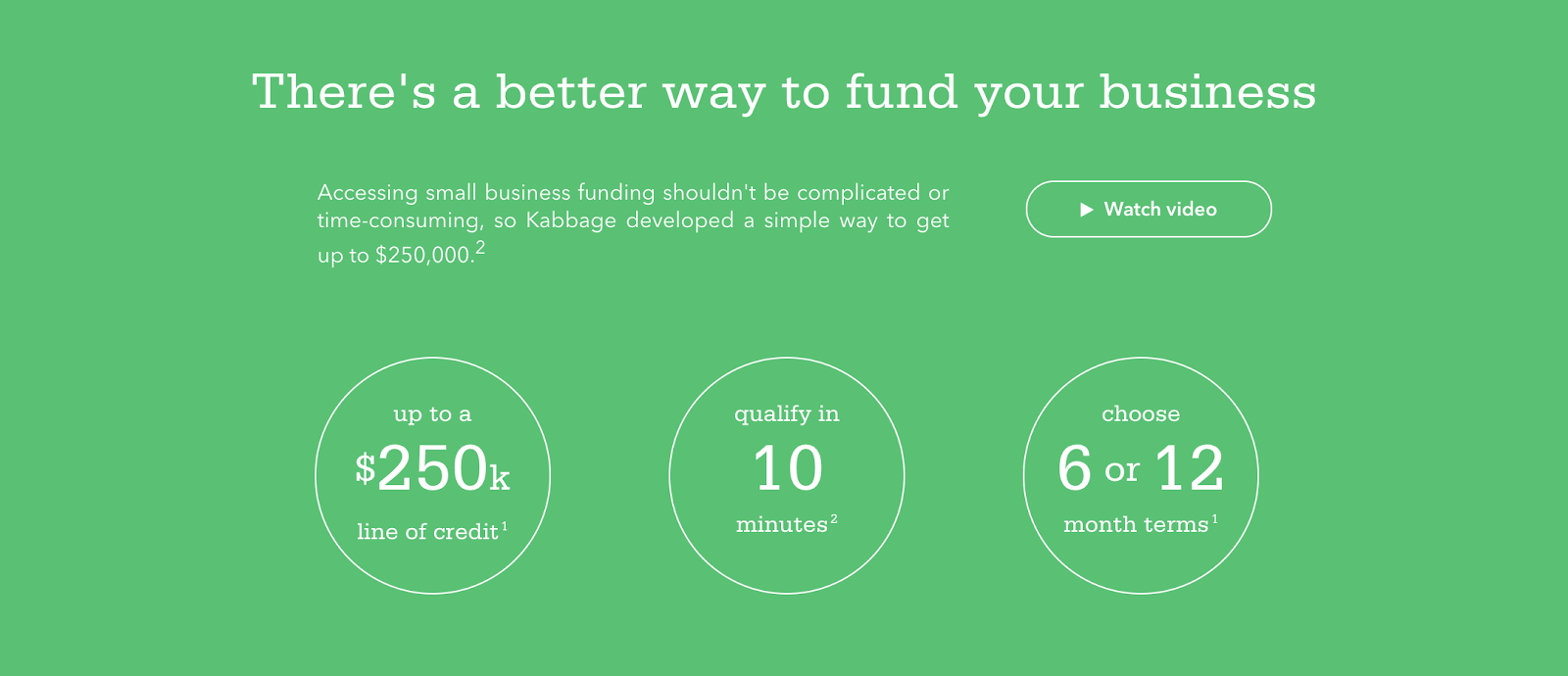

Online lenders are putting RPA to work in their borrower qualification processes, too – and when it comes to automation in lending, Kabbage is a powerful example of the payoff potential.

An Atlanta-based small business lender, Kabbage advertises that applicants can qualify for “up to a 250k line of credit” in 10 minutes. This ultra-rapid qualification time is enabled by a powerful suite of process automation technology that allows businesses to link various online accounts – from social media, to bank accounts and PayPal, to QuickBooks – all of which is automatically parsed by Kabbage’s software to generate a creditworthiness profile.

Competitors have sprung up in recent years: OnDeck, HyphenFunding, and Upgrade Inc. all advertise a quick, automated loan approval process. The sector is booming. Since Kabbage’s founding in 2011, it’s amassed $1.7 billion in funding. Upgrade Inc.’s series A funding round raked in $60 million last year, the largest ever series A round for a U.S. fintech firm. And at the heart of all of these automated lenders is process automation, powered by reliable data.

Powering Intelligent Automation with Utility Data

The data that online lenders use to automate their credit assessment processes – from social follower numbers to shipping volume – all serve as good indicators of a business’ likelihood of repayment. Large numbers of social media followers may indicate that a business is well-regarded by its customers; high monthly shipping expenses may demonstrate that it’s making a large number of sales. Bank balances aren’t the only factor that today’s lenders consider: they’re losing ground by alternative data streams that can offer a fuller picture of a borrower’s creditworthiness.

Urjanet, the world’s largest utility data aggregator, can add another data stream to that equation. Utility bill payment history offers valuable insights into a customer’s financial behavior. A deep history of timely utility bill payment demonstrates financial responsibility; likewise, a record of late payments may identify a credit risk that other metrics can miss. Our Utility Data Platform retrieves all data points from a customer’s utility bills, normalizes the data, and delivers it in a variety of formats, automatically. We enable lenders to serve new markets with confidence, and offer their customers more credit with less hassle.

To learn more about how Urjanet’s Utility Data Platform can help power tomorrow’s credit scoring technologies, check out our solutions brief. And if you’re ready to learn what Urjanet can do for your business, contact us today.

Related Resources:

- From KYC to KYB: A Brief History

- Say “Yes” to the Consumer

- eCredable Redefines Credit Reporting with Utility & Telecom Payment Data

If you like what you’re reading, why not subscribe?

About Amy Hou

Amy Hou is a Marketing Manager at Urjanet, overseeing content and communications. She enjoys writing about the latest industry updates in sustainability, energy efficiency, and data innovation.