How to Maximize Your Solar Investment and Track ROI

Amy Hou | June 25, 2019 | Energy & Sustainability

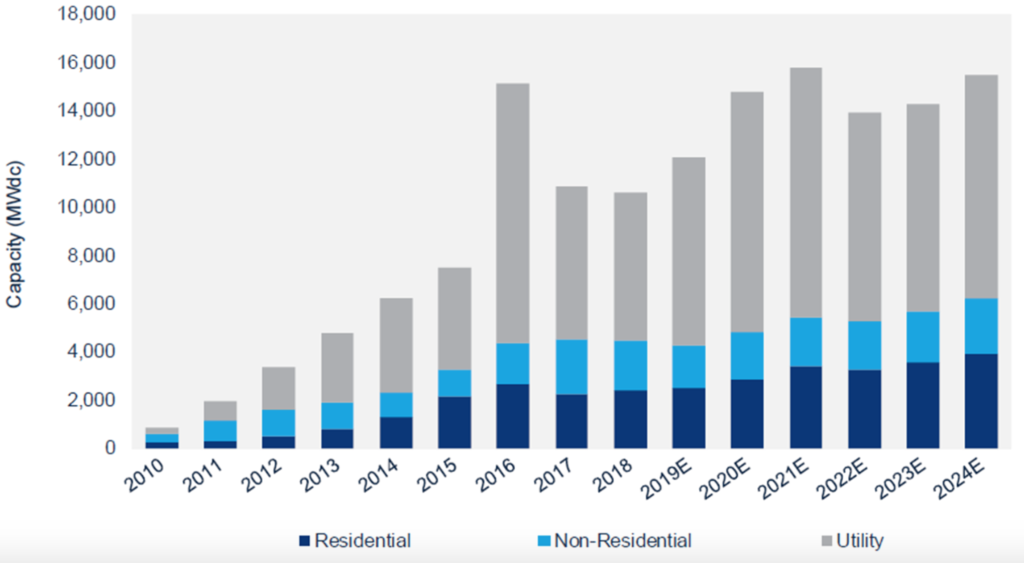

In the last decade, solar energy has gone from a frontier technology to a cost-effective and environmentally friendly solution for consumers. As a result, residential and commercial solar installation has seen unprecedented growth. To continue this level of growth, however, customers will need to see the return on investment. So, let’s dive into how you can calculate the ROI of your installation and get the most out of your solar investment.

Why is solar growing so fast? In part, because of the incentives set up to maximize ROI for customers. Policies in the U.S. and across Europe offer generous tax incentives to encourage adoption from homeowners and businesses. Clean energy-friendly policies like these will continue to proliferate as global climate commitments take center stage.

Savings to gain from going solar

1. Reducing energy bills

One of the most clear-cut benefits of switching to solar is the ability to reduce your energy costs. Electricity bills make up a significant portion of monthly expenses for both homeowners and businesses, and these costs have risen on average by three percent per year over the last decade.

With a solar panel system, you can get a fixed electricity rate and avoid unpredictable spikes or surges. This is especially beneficial for anyone with a fixed income, as well as for businesses that could use more stable cash flow. By making your energy costs more predictable, you will also improve your expense forecasting and management capabilities moving forward.

2. Earning tax credits and rebates

Financially speaking, if there were ever a time to invest in solar, the time would be now. The federal solar tax credit in the U.S., otherwise known as the investment tax credit (ITC), allows you to deduct a significant percentage of the cost of installing a solar energy system from your taxes. The current tax credit is at 30 percent, meaning if you install a solar panel system on your roof, you qualify for a credit equal to 30 percent of your total cost.

The ITC has eased the financial burden of installing solar panels for many homeowners and businesses, leading to remarkable growth in the solar industry. However, 2019 is the last year you can take advantage of the full value of the ITC, as it begins stepping down to 10 percent for commercial projects and zero for residential installations by 2022.

3. Saving money in the long run

Like any recurring costs, energy bills can reach up to several thousands of dollars annually. Luckily with solar panels, the more energy you use, the more money you save. Your savings will rapidly make up for the initial installation, even faster if electricity rates are high in your area. And, since electricity prices are projected to continuously rise, your savings will grow every year over the 25+ year lifespan of your solar panel system.

Tracking your solar ROI

What are the first steps?

So, you know that in general, you’ll save on your solar investment. But before you decide to purchase, you should get an estimate for how long it will take for the installation to pay for itself in savings (also known as the payback period). The starting point to calculate your solar ROI is to summarize how much you pay for electricity now.

Most solar installers will ask for an estimate from you, or to send them one utility bill. But if they’re only looking at one month’s consumption, their projection of your ROI will be inaccurate. Energy usage fluctuates several times during the year as the seasons’ change, so to get an accurate estimate of ROI, you should base your calculations off of 12 months of energy usage history.

Urjanet can help installers access 12 months of utility bill history with one simple process. Customers interested in solar can opt-in to link their utility accounts with Urjanet, providing instant, digitized access to an accurate history of energy consumption and spend. With Urjanet utility data, installers can generate trusted proposals and precise ROI calculations, so that consumers get exactly what they’re promised.

How to calculate the ROI

Once you know how much you spent on electricity over the last year, to determine your solar ROI, simply divide the total cost of the system by the annual benefit of installing the system. For example, let’s say a panel system costs $20,000 with both purchase and installation fees included. You paid $2,500 in electric bills to power your home before installation. Take the cost of the system ($20,000) and divide it by the annual benefit of owning the system ($2,500). Thus, the system has a payback period of 8 years.

The calculation is simple, but it should be taken into consideration before pulling the trigger on any solar investment. Typically, the cost of installing a system falls between $20,000 and $30,000, but this cost can be partially offset by tax incentives. Make sure to do your research and get an accurate estimate of your solar ROI before investing at this magnitude.

How can you maximize your solar investment?

Be smart with your energy usage

We’re not done yet: after you’ve gotten your installation, you can still take action to get the most out of your solar investment. For example, you should strive to use the power within your property during the day, while the solar system is generating electricity. Take advantage of daylight hours to do energy-intensive activities, like running the dishwasher and doing laundry.

Another way to be smart with your energy usage is to invest in battery storage. You can get even more out of your solar investment if you pair it with a battery, taking excess energy generated throughout the day and storing it for later use. Utilities often charge higher rates for on-peak hours, so if you can rely on both your solar system and stored energy during those times, you’ll avoid high costs.

Take advantage of governmental offers

As we mentioned, tax incentives can help you reduce the cost of your solar installation. These incentives are not going to be available for much longer, so it is important to jump on the opportunity while it still stands.

Another opportunity to take advantage of is solar renewable energy credits (SRECs). SRECs are a tradable commodity that you obtain from owning a solar panel system and producing clean energy. They are not available in every state, but they can provide sizable income to system owners who live in areas with SREC markets. The average system generates two to six credits per year, which can be sold to utility companies for up to $300 each.

All in all, if you take the time to get an accurate estimate of your solar ROI and maximize it along the way, you’ll see rapid returns on your solar investment – all while contributing to the clean energy economy.

You might also like:

- Shedding Light on Solar: How Utility Data Drives Revenue Growth

- Why Solar Customers Want and Expect Personalization

If you like what you’re reading, why not subscribe?

About Amy Hou

Amy Hou is a Marketing Manager at Urjanet, overseeing content and communications. She enjoys writing about the latest industry updates in sustainability, energy efficiency, and data innovation.

You May Also Like

Support Business Continuity by Embracing ESG

Honor Donnie | March 18, 2022 | Energy & Sustainability