How to Fill ESG Data Gaps Before 2020

Amy Hou | February 28, 2019 | Energy & Sustainability

Climate change often feels like a gradual, slow-moving challenge to solve at some point in the future. Yet report after report has shown: there’s no time for gradual change anymore. We have until 2020 to take “extraordinary action,” just to keep warming below 1.5℃. The climate turning point is fast approaching, but we have a number of obstacles to overcome first. One that is easy to recognize – and relatively easy to fix – is ESG data gaps.

The climate turning point arrives soon

Here’s what we mean by the ‘climate turning point.’ A 2018 UN Environment report suggested that in order to meet the 1.5℃ target, global GHG emissions should peak by 2020 and decline thereafter. Of course, there’s a glaring situation we need to acknowledge: it’s already 2019. So, let’s take a look at how we’re doing so far.

Energy

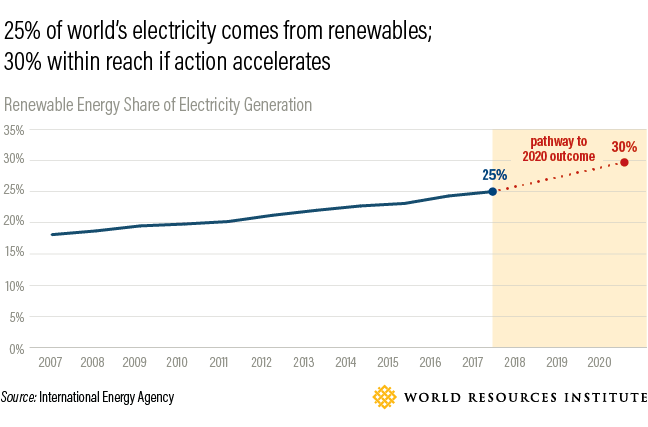

Before we reach the climate turning point, we need to source 30 percent of global electricity from renewables and get coal-fired power plants offline. Renewables generation is close to being on track, if we continue to accelerate adoption. However, we’re far off track when it comes to retiring coal plants: policy change around closing plants has been slow, and new plants are still being built today.

Related >> The Road to 100 Percent Renewable Energy

Infrastructure

The World Resources Institute (WRI) set three main infrastructure goals to track up to the climate turning point:

- Infrastructure decarbonization should be funded by $300 billion in annual investments

- New buildings should be built to zero or near-zero energy standards

- About 3% of existing buildings should be upgraded to zero or near-zero standards every year

Unfortunately, every one of these goals is either off-track or untrackable at the moment, due to insufficient data. While the number of zero energy buildings has rapidly grown, especially in the U.S. and Canada, the overall proportion of new construction worldwide that meets the standards remains low.

Finance

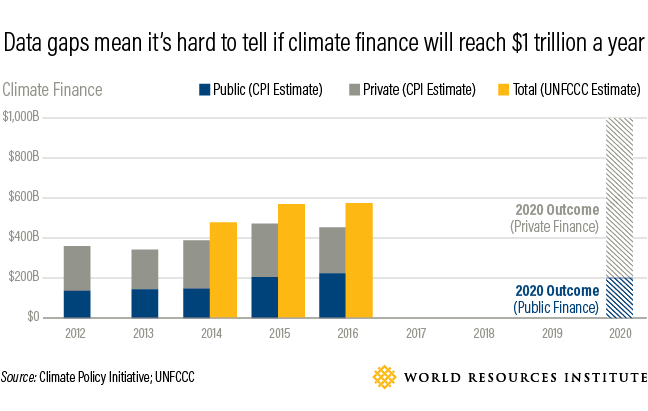

Finance goals for 2020 are ambitious, and unsurprisingly, hard to track. The public sector is on track to invest $200 billion in climate action annually. But other goals, like carbon pricing and climate-related financial disclosure, lack sufficient data to accurately report on.

Seeing a common thread yet? We are, too. Before we can track how well we’re doing on these targets, we need accurate and comprehensive data. And it seems to be hard to find, as data gaps continue to present a challenge for private and public sectors alike.

A lack of transparency stands in the way

Nearly one-third of all the metrics WRI tracks lack sufficient data to come to a conclusion. WRI fully acknowledges that its studies are limited by data availability; according to the report, “efforts are needed to increase transparency and generate necessary data to hold countries, companies, and regions accountable.”

It’s not just nonprofits and research experts that see this limitation, either. Companies themselves are aware. More than 40 percent of CEOs admit that they can’t accurately quantify the business value of their sustainability initiatives.

If companies can’t tie sustainability efforts to financial performance, they’ll continue to treat ESG initiatives as a nice-to-have. They won’t hold themselves accountable to meeting critical climate milestones, much less contribute valid data on progress. The solution, then, is clear: companies need to step up and fill these ESG data gaps.

How to fill in ESG data gaps

With comprehensive and trustworthy reporting, companies can not only track their individual progress on climate goals, but also build a business case for sustained investments. It’s not as though there is no ESG data reported today: many companies use standardized frameworks like CDP and GRI to provide transparent disclosure.

Investors, however, are not happy with the quality of data being reported. According to WRI, investors see several common ESG data gaps:

- Poor coverage – Companies often fail to report environmental data across their entire portfolios, typically due to a lack of available data.

- Inconsistent metrics – Across the different frameworks, both the data itself and how it’s collected varies dramatically, not to mention reporting from companies that build their own frameworks.

- Immaterial reporting – Poor quality data is a consistent issue: most companies use “generic boilerplate language or tailored narrative, rather than robust quantitative performance indicators, such as metrics on energy intensity or water consumption.”

Most companies use generic boilerplate language or tailored narrative, rather than robust quantitative performance indicators.

Not ones to present a problem without a solution, investors have suggested steps that businesses can take to boost transparency in their reporting and fill these ESG data gaps. Companies should use forward-looking analysis to estimate the physical risks of climate events. They should link their data to investor-friendly standards like SASB and science-based targets. And they should delve into granular, asset-level data.

Feel-good language is no longer enough to hide the real gaps that exist in ESG reporting. Investors want to see comprehensive data, across a company’s entire portfolio, and quantified metrics. While some data sources are harder to access than others, businesses have the resources they need to start building a centralized stream of ESG data.

The time is now

If the climate turning point weren’t enough incentive to act now, investors are running out of patience, too. ESG-oriented investments have nearly doubled in the past few years to $23 trillion globally, and yet: companies are still not on the same page with their investors.

In response to a PwC survey, 39 percent of corporate directors think climate change is irrelevant to business strategy, and 30 percent think shareholders pay too much attention to the issue.

There’s both an environmental case and a business case to invest in better ESG reporting. Companies have run out of excuses – and soon they’ll run out of time. To accurately track progress toward climate goals, and to boost investor confidence, ESG disclosure needs to be robust and quantified. Learn more about improving your ESG data quality with these five best practices.

You may also like:

- Webinar: 5 Ways to Ensure Data Quality for Sustainability Reporting

- Powering Investor-Worthy ESG Reporting

- ESG Best Practices for Growing Sustainability Programs

If you like what you’re reading, why not subscribe?

About Amy Hou

Amy Hou is a Marketing Manager at Urjanet, overseeing content and communications. She enjoys writing about the latest industry updates in sustainability, energy efficiency, and data innovation.

You May Also Like

Support Business Continuity by Embracing ESG

Honor Donnie | March 18, 2022 | Energy & Sustainability