Powering Investor-Worthy ESG Reporting

Amy Hou | August 23, 2018 | Energy & Sustainability

ESG reporting is going mainstream. Environmental, social, and governance (ESG) data disclosure gives investors a unique look inside the way a corporation treats its workers, its shareholders, and the planet. In the past few years, it’s gone from an investment afterthought to a mainstay of investment disclosures: in 2019, 90 percent of S&P 500 companies released a sustainability report, up from 53 percent in 2012.

A 2016 PwC report, Investors, Corporates, and ESG: Bridging the Gap, made the case for ESG reporting: “For the past decade or so, we have been hearing that investors are interested in ESG factors and that they are considering them in making their investment decisions. Investors want to know about a company’s exposure to climate risk, its efficiency and stewardship in using natural resources, the quality and safety of its products, the type of product claims it makes, and how it treats its workers … But there isn’t complete alignment between investors and companies on what, where, and how often to report.”

In short, investors see ESG as a potentially valuable window into a company’s responsibility and philosophy, and companies see it as a way to show off their social and environmental stewardship, the quality of their leadership, and their ability to attract new talent. But corporations and investors aren’t quite speaking the same language, and for ESG’s relevance and quality to continue its upward trend, that will need to change.

Investors want more out of ESG data disclosure

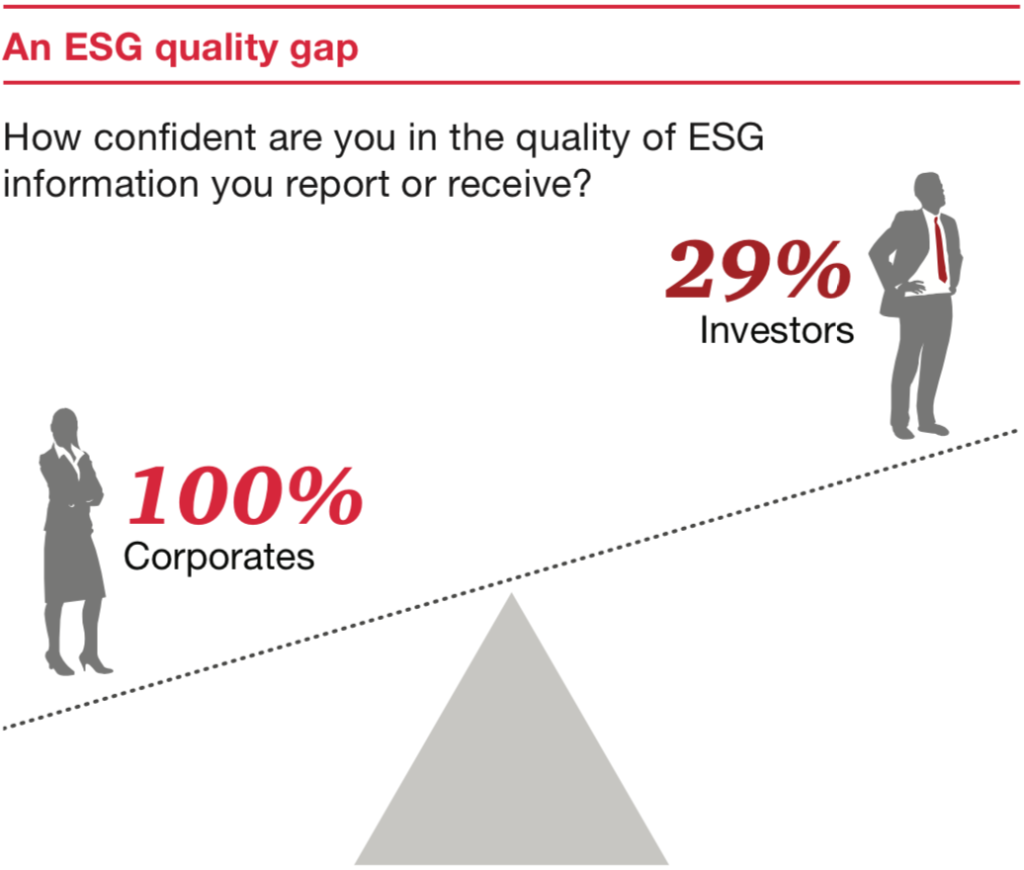

According to PwC, 100 percent of surveyed corporations are confident in the quality of the ESG information they report; by contrast, only 29 percent of investors report confidence in the ESG data disclosure they see from corporations. This discrepancy suggests a need for both a mutually satisfactory ESG reporting framework and a system of governmental or third-party certification of corporate ESG reports.

Third parties like Intertek offer this sort of outsourced ESG verification, helping corporations to convince investors that their ESG reports are complete and trustworthy. These third parties may be the key providers of oversight in this space for the foreseeable future since the SEC has warned that its ability to verify corporate climate disclosures is “limited.”

Another snag? 80 percent of companies surveyed by PwC say they use the Global Reporting Initiative (GRI) ESG reporting framework, while 43 percent of investors say they would prefer to see ESG information aligned with Sustainability Accounting Standards Board (SASB) guidelines. So in a real way, companies and investors aren’t speaking the same sustainability language. (Thankfully, GRI and SASB have taken steps to complement each other, in an attempt to ease some of this friction.)

Boosting confidence in ESG reporting

One way to increase investor confidence in the quality of reporting is to rely on a sustainability reporting software platform. Industry-leading software applications can help firms easily navigate different reporting standards and prove the accuracy of their ESG data.

Measurabl, for instance, provides exactly this sort of service. Measurabl advertises “investment-grade” sustainability reporting data, allowing firms to confidently track their sustainability metrics and make measurable progress toward their stated sustainability goals. This real-time record keeping enables transparent ESG data disclosure and powers the kind of ESG reporting that investors need to feel confident in a company’s social and ethical standing. By simply inputting accurate utility bill data, companies can be sure they’re hitting their targets – and make investors sure, too.

Urjanet’s Utility Data Platform is the engine that helps to power sustainability services like Measurabl. Urjanet’s technology automatically retrieves, processes, and delivers businesses’ utility data into the sustainability platform of their choice, keeping their sustainability program up to date and helping them keep tabs on their energy use, carbon footprint, and broader environmental goals. Armed with a reliable sustainability platform powered by accurate data, businesses can feel confident in their sustainability reports – and investors can trust that the data they’re seeing is legitimate.

To learn more about how Urjanet and Measurabl work together to ensure data quality for ESG reporting, watch our recent webcast. And if you’re ready to power your software platform with Urjanet, contact us today.

Related Resources:

- 6 Sustainability Dashboard Views Proven to Drive Results

- ESG Best Practices for Growing Sustainability Programs

- Webinar Recap: 5 Ways to Audit Data Quality in Sustainability Reporting

If you like what you’re reading, why not subscribe?

About Amy Hou

Amy Hou is a Marketing Manager at Urjanet, overseeing content and communications. She enjoys writing about the latest industry updates in sustainability, energy efficiency, and data innovation.

You May Also Like

Support Business Continuity by Embracing ESG

Honor Donnie | March 18, 2022 | Energy & Sustainability