Elevate ESG Performance Reporting with Automated Utility Data

Honor Donnie | November 8, 2021 | Energy & Sustainability

As environmental, social, and governance (ESG) gains steam, companies continue to shift their focus and strategies. Today companies aren’t just focused on the financial factors impacting their business; they’re also in search of ways to enhance their ESG performance reporting to gain a more holistic view of potential risk and growth opportunities. A recent survey of public companies showed that 59 percent of them have increased their disclosures regarding climate risk. Thirty-four percent of respondents also voluntarily disclose information on the risk related to climate change, greenhouse gas emissions, or energy sourcing in their filings.

Now that more companies are taking the step to disclose voluntarily, it’s time to ensure they have quality and granular data to support their sustainability programs and proposed changes to reporting expectations.

Prepare for the shifts

Investors and consumers aren’t the only ones seeking greater transparency from companies. The Securities and Exchange Commission may soon require publicly traded companies to disclose emissions by partners and suppliers. The agency is considering implementing requirements and phases for companies to report their greenhouse gas emissions and climate change risk management plans.

Proposed rules include tiered compliance for small and large companies, various climate disclosures, and quantitative reporting on gas emissions and the financial impacts of climate change. With several changes on the horizon, companies need to prepare for the shifts – this includes ensuring they have the right processes, platforms, and data to support emissions reporting.

As the current administration puts climate change back on the agenda of U.S. policy, companies need to be prepared for the future of ESG data management. Along with the milestones the country has agreed to meet by 2030 under the Paris agreement, the government aims to set targets to reach net-zero emissions by 2050. By elevating your ESG performance reporting now, companies will get ahead of this upcoming regulation. Implementing reliable data strengthens the reports and helps solidify the foundation of ESG goals for the future.

In 2019 52 of the world’s largest companies did not fully disclose both scope 1 or 2 emissions.

Scoping out your ESG Reporting metrics

Although all ESG Reporting metrics are rising to the top of the agenda, measuring environmental data is often considered the most technically challenging.

In 2019 52 of the world’s largest companies did not fully disclose both scope 1 or 2 emissions, and 78 remitted their scope 3 emissions.

There are different stakeholders to consider as your company elevates its ESG reporting framework. From investors, customers, employees, and communities – each group is looking for something different. Investors want the full scope of your ESG performance to ensure that your practices will ensure longevity. The pandemic and worsening climate conditions have shown that customers and communities care about how their favorite products and services impact their lives. With a robust ESG reporting framework, your company will be able to streamline efforts to ensure better outcomes.

Measuring each scope requires secured data – scope 1 accounts for the direct emissions from companies, scope 2 accounts for the indirect emissions from purchased electricity, and scope 3 includes all other indirect emissions that occur in a company’s value chain. Quality and reliable utility data help improve transparency and provide organizations with the information for climate policies and business goals. These emission data points are then reported to stakeholders.

TEST YOUR COMPANY’S SUSTAINABILITY STRATEGY WITH OUR SCORECARD

Support your ESG performance reporting with reliable utility data

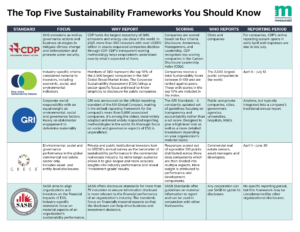

The days of putting ESG reporting metrics at the bottom of your company’s to-do list are long gone. For many, there is an expectation of ESG performance reporting, and choosing not to can negatively impact companies. When it comes to the environmental side of ESG reporting, guidance frameworks will help measure the impact of your direct and indirect emissions and provide investors, consumers, and government agencies with the insights they need. Using utility data to quantify your reports will ensure a strong foundation in your company’s ESG reporting framework.

With Urjanet’s help, you can directly and automatically access the data you need to support the E in your ESG reporting metrics. Our solution provides quality utility data for scope 1 and 2 and a 99 percent accuracy rate that stakeholders can rely on. Are you ready to elevate your ESG reporting framework with utility data? Speak with one of our data experts today to get started.

YOU MIGHT ALSO BE INTERESTED IN:

- ESG Data Management: Fueling Reporting with the Right Data

- How to Begin Your Company’s ESG Reporting Journey

- How Companies Can Strengthen Their Commitment to ESG

If you like what you’re reading, why not subscribe?

About Honor Donnie

Honor Donnie is a Marketing Coordinator at Urjanet, with a passion for content creation. When she’s not at Urjanet, she can be found reading, cooking, and listening to great music.

You May Also Like

Support Business Continuity by Embracing ESG

Honor Donnie | March 18, 2022 | Energy & Sustainability