The Sliding Scale of Friction

Amy Hou | January 24, 2019 | ID Verification

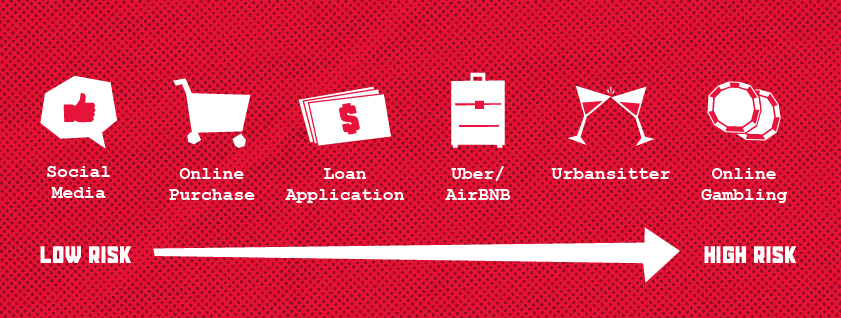

The holy grail in identity verification is a seamless, frictionless user experience that takes no extra time or effort for the user, yet simultaneously is utterly effective at keeping out fraudsters. Sounds easy, right? Not so much. The real solution is much more nuanced. Deciding where to apply more friction and thus more security in the process should be visualized as more of a spectrum. So without further ado, here’s our sliding scale of low friction to high friction situations.

Low Risk, Low Friction

Friction certainly doesn’t belong everywhere. It lowers conversion rates: 69 percent of all online shopping carts are abandoned, and 25 percent of all those who abandon their cart say it was because the checkout process was too long or complicated. That’s why in low-risk, low-value transactions, additional friction is unnecessary. These situations include:

- Opening new social media accounts

- Small online purchases

- Familiar, trusted users

Most users have come to expect at least a couple steps to verify identity; they’re incentivized to avoid fraud, too. But if they have followed those basic steps and haven’t displayed any signs of fraud, they shouldn’t be penalized with unnecessarily high friction.

High Risk, High Friction

On the other side of the spectrum, though, lie transactions that are too high-value to risk low security. Here are some prime examples.

Physical security concerns

Digital identity in the new sharing economy is tough to pin down. Services like AirBnB and Lyft make life easier for the user, but they also make life easier for the fraudster. And fraud in these situations is risky. Think about it: would you feel comfortable letting a stranger drive you around if you weren’t sure whether they had a valid driver’s license?

91% of Americans are more likely to do business with in-home services that validate identity before inviting someone into their home.

Other services are even riskier. Consumers who use UrbanSitter to find a babysitter or Wag to find a dog walker have to put a lot of trust in these services when it comes to some of the most important people (or animals) in their lives. It’s unsurprising, then, that 91 percent of Americans would rather do business with in-home services like dog walking and home repair that validate identity over ones that don’t.

Legality issues

Another area where high friction becomes more important is when compliance is involved. Regulators are starting to crack down on online sales of eCigarettes and similar devices, so verification methods will need to get stricter to confidently verify that shoppers are over the age of 18. Online gaming is another example: gambling is only legal in certain U.S. states, so gaming services need to be sure that users actually live in those states.

Learn how utility bill data works to verify name and proof of address with direct-from-source data.

New and emerging markets have to deal with more compliance issues than more established ones. For instance, have you tried trading in cryptocurrency? Opening an account takes but a few steps. But try to make some larger-value transactions, and you’ll hit more and more friction. It’s unfortunately necessary in high-risk situations like these, which is why Coinbase requires 2FA for every customer.

Declined applicants

As we mentioned, you shouldn’t penalize a trusted customer with high friction. But new applicants who fail initial verification need to be treated with caution. Red flags might have been raised around them, but not all of them are fraudsters, either. Those who are genuine users will be more willing to undergo some extra steps in order to get access to the service they need.

In these cases, businesses will have to resort to some out-of-the-box solutions in order to verify identity. Traditional sources won’t cut it. User-permissioned utility data, for example, can verify a user’s name and address through their utility account history. It adds a little extra friction, but in high-risk, high-value transactions, a little friction can go a long way.

When it comes to friction in identity verification, it’s not an all-or-nothing game. It takes time and nuanced decision-making to determine where and when high friction best applies (if at all). To learn more about how to make these decisions, check out our guide to high risk, high security ID verification.

You might also be interested in:

- Webinar: Understanding ID Verification in a Digital World

- Utility Bill Identity Verification for the 21st Century

- Direct-From-Source Data Tightens Security and Compliance for Online Gambling ID Verification

If you like what you’re reading, why not subscribe?

About Amy Hou

Amy Hou is a Marketing Manager at Urjanet, overseeing content and communications. She enjoys writing about the latest industry updates in sustainability, energy efficiency, and data innovation.

You May Also Like

Overcome Customer Onboarding Challenges in the Financial Sector

Honor Donnie | December 16, 2021 | Data & Technology | ID Verification