2 Major Shifts That Are Changing European Solar Markets

Amy Hou | February 14, 2019 | Energy & Sustainability

European solar markets take charge

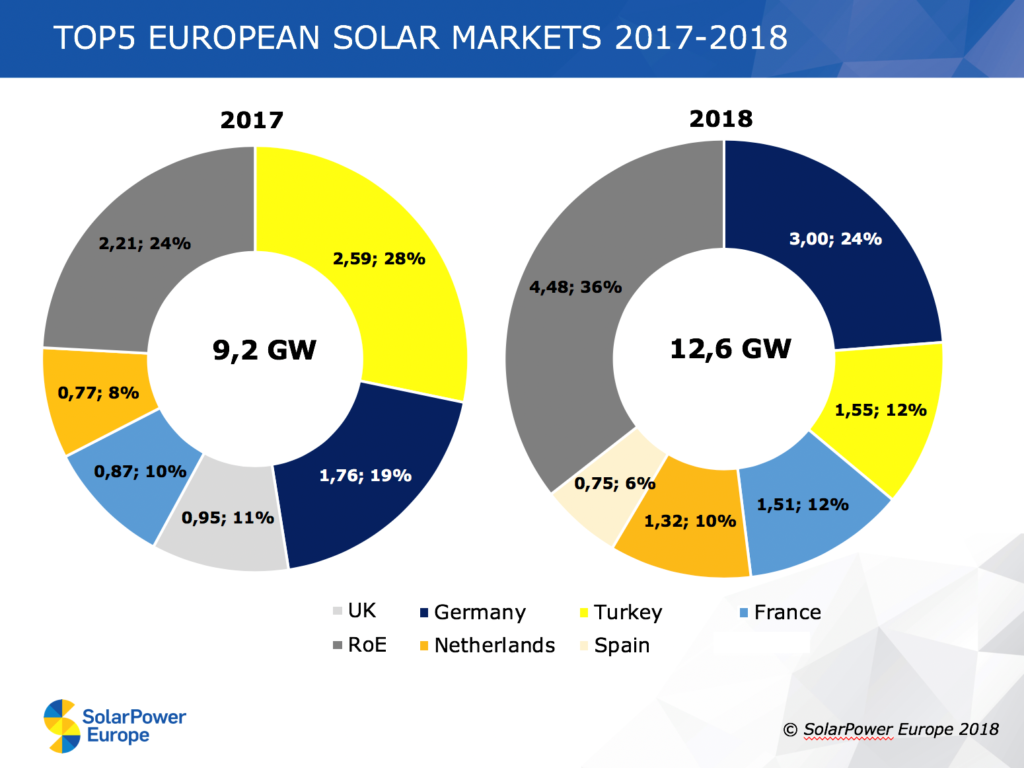

Throughout 2018, a handful of European nations made major strides in the solar industry. With the help of the EU, the region is fully committed to a renewable future, with subsidy-free renewables to boot. European solar markets are exponentially growing, expected to add 10 to 17 gigawatts per year through 2022, bringing the continent’s total to 182 gigawatts.

“Solar is exceeding our projections,” said Michael Schmela, Executive Advisor and Head of Market Intelligence at SolarPower Europe. Installations in 2018 rapidly surpassed the group’s projections published in the Global Market Outlook report.

In 2018 – partially in response to the removal of the MIP for Chinese imports – the demand for solar grew by over 60 percent, creating about 45,000 jobs in solar. European solar markets, including Germany, Spain, France, the Netherlands, and Ukraine will all expect an increase in installation capacity.

The road to subsidy-free renewables

What’s notable is that European solar markets aren’t just growing; they’re growing unsubsidized. To date, dozens of renewable energy projects have broken ground without subsidies in Europe, a telling sign that costs of solar technology are dramatically dropping. The EU is expected to continue to phase out subsidies more of these projects develop profitably.

Of course, labeling them subsidy-free renewables isn’t as simple as it sounds. These projects no longer need the government to fund the retail cost of the power they produce. But, companies are still gaining assistance in the form of renewable energy mandates, tax breaks, and research and development.

It’s important to note that the switch to a post-subsidy world would still need some financial assistance during the transition period. Nevertheless, subsidy-free renewables will be a true game changer for the energy industry.

Bringing down barriers

Another major shift in European solar markets is the removal of tariffs on Chinese solar panels. After the announcement in September of 2018, experts predicted the price of solar panels to drop by as much as 30 percent.

Sun Investment Group’s Chief Business Development Officer, Andrius Terskovas said: “Given 2018’s shift in attitudes towards renewables from even the most coal-friendly countries in Europe and the removal of tariffs on Chinese solar panels, investments in solar energy and renewables, in general, will become more attractive than ever for investors in 2019.”

“Investments in solar energy will become more attractive than ever for investors in 2019.”

The European Commission initially placed anti-dumping tariffs on solar panels imported from China in 2013, as European manufacturers complained they were being forced out of business by underpriced Chinese imports. The tariffs were ultimately lifted to foster the continued growth of solar in Europe, taking the needs of both producers and users into account.

Lessons learned

On a macro level, it’s not easy to make an apples-to-apples comparison between Europe and the rest of the world. Yet, other countries can still learn valuable lessons from Europe’s rapid growth in solar. The overwhelmingly positive market response to the MIP expiration adds to the list of arguments for the reduction (or outright removal) of trade barriers between nations. And while subsidy-free renewables are likely further off from adoption in countries like the U.S., profitable projects in Europe will hopefully pave the way for other nations.

Interested in reading more about the future of solar market growth in countries like the U.S.? Check out our eBook.

You might also be interested in:

- 5 Ways to Accelerate Solar Sales

- Achieving Net Profit Without Net Metering

- The Road to 100 Percent Renewable Energy

If you like what you’re reading, why not subscribe?

About Amy Hou

Amy Hou is a Marketing Manager at Urjanet, overseeing content and communications. She enjoys writing about the latest industry updates in sustainability, energy efficiency, and data innovation.

You May Also Like

Support Business Continuity by Embracing ESG

Honor Donnie | March 18, 2022 | Energy & Sustainability