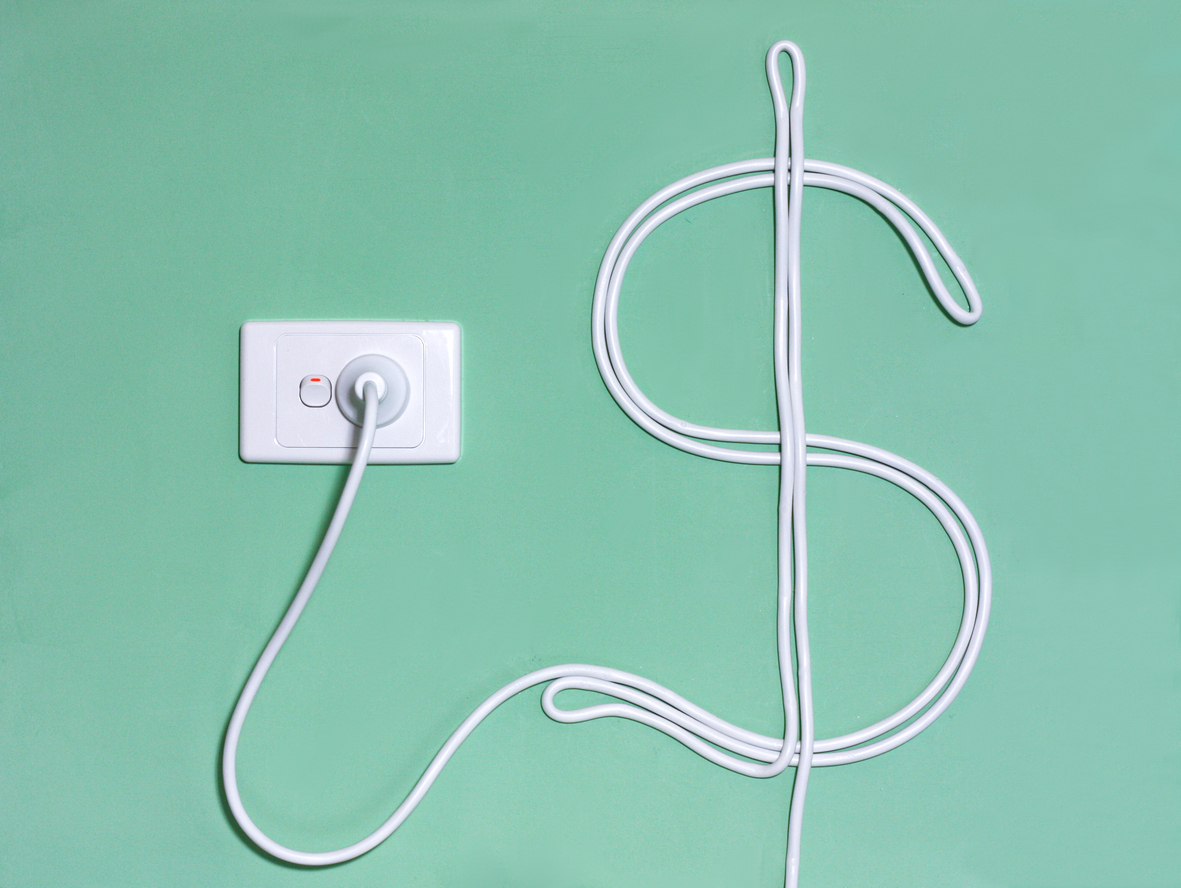

Don’t Let Utility Costs Sink Your Profitability

Amy Hou | November 16, 2017 | Energy & Sustainability

This post was contributed by Chris Pieper, Vice President of Marketing at Artis Energy

Even if sales growth is strong, it doesn’t necessarily translate into profitability growth. For many businesses, unexpected and difficult to forecast expenses, like utility costs, can cause profits to sink. In fact, the median net profit across 212 industries in a Yahoo Finance database is only 6.5 percent, according to an AEI analysis.

Grocery stores, for instance, operate on a tight net margin of only 1.4 percent on average, so unexpected expenses can easily make the difference between profitability and being upside down, particularly as other costs such as rent and wages rise.

Why Utilities Matter

For many businesses, energy is a top three operating expense, but it is often an overlooked cost category as many companies consider it fixed and opaque.

At a full-service hotel, for instance, energy costs equal four to six percent of total revenue, according to National Grid. Suppose a hotel chain had had $10 billion in annual revenue at a five percent profit margin. That would mean that profits equal $500 million for the year, while energy utilities equal $400 million to $600 million. Considering that commercial buildings waste 30 percent of the energy they consume, if the hotel chain removed that waste they could save an additional $120 million to $180 million per year, equaling an additional 24 to 36 percent more profit.

On the flip side, higher costs from utilities would eat into that profit margin, and if charges doubled, the balance sheet could go into the red. While that would be a dramatic scenario, it’s theoretically possible because energy usage itself wouldn’t have to double; instead, using energy at the wrong times could lead to much higher costs.

How Companies Can Better Manage Utility Bills

To avoid being hit with surprise charges, companies should take advantage of both hardware and software that can prevent price spikes.

Energy analytics software (EAS), for instance, allows businesses to monitor their energy usage in real time, and if a peak period approaches or energy prices per kilowatt hour (kWh) increase, businesses can identify curtailment strategies that would allow them to stay within budget.

In the case of a hotel, demand might be highest at the start of a check-in time as guests enter their rooms and consume energy by turning on the lights and TV. To counter this surge, the hotel could reduce its employees’ usage, for instance by pausing laundry during that period so that the hotel’s energy load is more evenly distributed throughout the day.

And smart devices can help. They can order laundry machines to automatically lock during these high demand periods to avoid usage. Plus, they can help increase general efficiency by automatically turning off when not in use so that energy is not wasted. As a result, businesses can reduce their utility bills and help ensure that they remain profitable.

Want to learn more about how utility bill data can help your company better understand your energy consumption? Contact us to speak to one of our utility data experts today.

Related Resources:

- 3 Ways to Improve Your ENERGY STAR Score

- The One Thing You Need to Cut Energy Costs in 2017

- Solutions Sheet: Utility Data for Energy Management & Procurement

If you like what you’re reading, why not subscribe?

About Amy Hou

Amy Hou is a Marketing Manager at Urjanet, overseeing content and communications. She enjoys writing about the latest industry updates in sustainability, energy efficiency, and data innovation.

You May Also Like

Support Business Continuity by Embracing ESG

Honor Donnie | March 18, 2022 | Energy & Sustainability