Can Supermajors Lead the Renewable Energy Revolution?

Amy Hou | August 1, 2018 | Energy & Sustainability

Fossil fuels and renewable energy – bitter rivals, right? Not exactly. The petroleum industry’s “supermajor” firms – ExxonMobil, BP, Royal Dutch Shell, ConocoPhillips, Chevron, and Total S.A. – invested billions in renewable energy last year, and that investment is expected to keep growing. Former BP Chief Executive, and current L1 Energy CEO, Lord John Browne argues in a recent Bloomberg op-ed that supermajor oil companies “will lead the energy revolution”.

This may come as an uplifting surprise to readers all too familiar with the massive environmental impact of Big Oil. It’s certainly welcome news for the planet. But it’s not altruism that’s driving supermajor oil companies to go green: it’s economics. In today’s blog, we’ll take a look inside the forces driving this trend and explore the potential impacts for energy spend and the bottom line.

Supermajors: from oil to renewable energy

Renewable energy firms looking for capital may increasingly turn to petroleum supermajors for funding. That’s what happened in the case of Synthetic Genomics, a San Diego-based biofuels developer who partnered with ExxonMobil back in 2009 to the tune of $600 million. The trend has accelerated in recent years. Last December, BP purchased a 44 percent stake in European solar provider Lightsource for $200 million; not to be outdone, Royal Dutch Shell invested $217 million in U.S. solar provider Silicon Ranch the following month.

Beneath the flashy PR of these colossal clean energy buy-ins lies an inevitable economic reality: when it comes to energy, nobody matches the reach or the resources of the petroleum supermajors. Since last June, the big six have generated a combined $51.6 billion in free cash flow. To quote the Motley Fool’s Maxx Chatsko: “That’s a lot of solar panels. Or research and development. Or equity investments in promising start-ups.”

Today’s investments, tomorrow’s clean tech

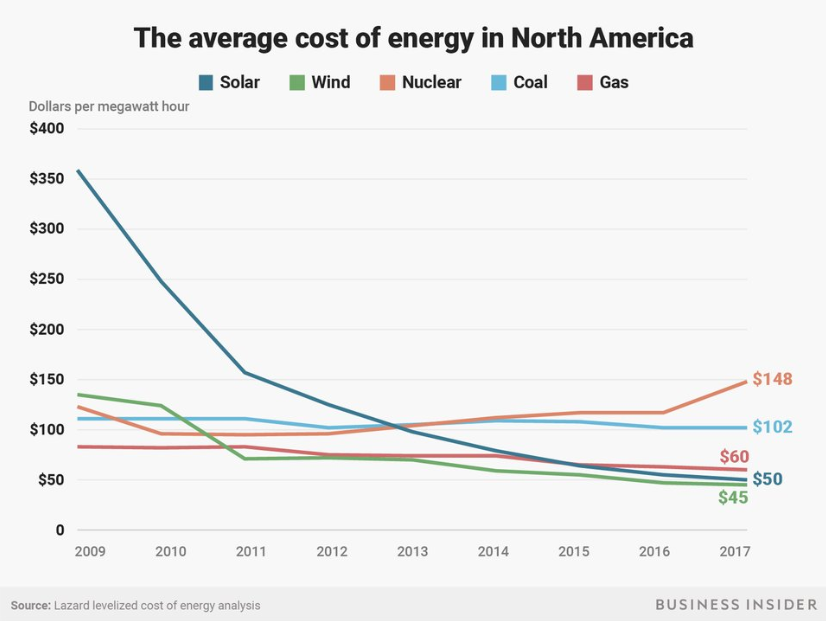

Another inescapable truism is also driving petroleum titans to pivot towards renewables: eventually, renewable energy will surpass fossil fuels for good. Oil is finite, and takes millions of years to develop from decaying organic matter; that means that reserves will become scarcer and harder to access, and therefore more costly, over time. Meanwhile, despite meeting only a small portion of today’s total energy needs, renewables like wind and solar power are only getting cheaper.

Oil supermajors, with decades and billions of dollars invested into developing a global energy infrastructure, have the most to lose from falling behind the cutting edge of energy technology – and quite a lot to gain by moving to dominate the renewables market in its infancy.

“A world powered by renewables is not around the corner … but the resiliency of the sector in the face of much lower oil and gas prices is a sign that it may just be on its way.”

Indeed, renewables like solar, hydroelectric, and wind are both cleaner and more reliably profitable than coal when it comes to power generation. Their adoption in the transportation sector remains low, however. This market segmentation means that demand for renewables is surprisingly independent of oil prices. As Scott Nyquist, Director of the Sustainability and Resource Productivity Center and the Oil and Gas Practice at McKinsey, notes: “a world powered by renewables is not around the corner. This will be a long-term transition—a matter of decades, not years. But the resiliency of the sector in the face of much lower oil and gas prices is a sign that it may just be on its way.”

Making the pivot

So, 100 percent renewable energy probably isn’t happening in the next few decades. But it is coming, and supermajors are profiting from their investments in alternative energy. Wood Mackenzie estimates that, by 2035, renewables could generate nearly three times more revenue than all of U.S. shale.

Do you have access to the data you need to make cost-effective procurement decisions? You might be missing this solution.

All of this revenue comes from one place: energy consumers’ bank accounts. So while renewables investments are gaining ground, and oil companies are diversifying into environmentally friendly energy sources, corporate energy consumers can also profit by cutting back their energy use. After all, the relative price inflexibility of electricity means that, despite falling oil prices, energy remains a significant, consistent cost for businesses. Energy managers understand this, and recognize the economic benefits of cutting back.

Urjanet’s Utility Data Platform delivers the timely, accurate utility data energy managers need to precisely monitor organizational energy spend and track the impacts of energy efficiency programs. To learn more about how Urjanet powers cutting-edge energy management, check out our Solutions Sheet: Utility Data for Energy Management & Procurement. And if you’re ready to take your energy management program to the next level with utility data, contact us today.

Related Resources:

- The Road to 100 Percent Renewable Energy

- Take Your Energy Management Program Beyond the Bill with Interval Data

- The Fast Track to Corporate Renewables

If you like what you’re reading, why not subscribe?

About Amy Hou

Amy Hou is a Marketing Manager at Urjanet, overseeing content and communications. She enjoys writing about the latest industry updates in sustainability, energy efficiency, and data innovation.

You May Also Like

Support Business Continuity by Embracing ESG

Honor Donnie | March 18, 2022 | Energy & Sustainability