Industry Leaders in Rent and Utility Payment Reporting Expand Options for Lenders to Broaden Financial Inclusion for 91.5 Million “Credit Invisible” American Consumers

LAS VEGAS, Oct. 28, 2019 – Urjanet, the global leader in utility data aggregation, and LevelCredit, a leading data furnisher helping consumers report their largest monthly expenses to their credit files, today announced a strategic partnership enabling lenders, banks, and fintech companies to confidently qualify thin and no-credit file consumers using rent and utility payment history. The partnership enhances LevelCredit’s existing rent reporting services with consumer-permissioned payment history from thousands of utility, cable, and telecom providers, helping financial services organizations safely extend credit to a growing number of consumers who aren’t getting the credit they deserve today.

Despite representing nearly 25% of consumer spend, until now rent, utility, cable, and telecom tradelines have been severely underreported in traditional credit reports, with only about 1% of consumer files currently including rent data and 2.4% including utility data according to FICO. When alternative data is included, it has proven to accurately score more than 90% of thin or no-file applicants, representing a powerful revenue tool that lenders can use to safely expand their markets, increase assets, and build lasting relationships with borrowers.

“Lenders, banks, and fintechs can now incorporate rent, utility, cable and telecom payment history to safely assess historically credit invisible consumers,” said Sanjoy Malik, CEO of Urjanet. “Consumer-permissioned alternative data is a powerful tool to help dismantle the ‘Credit Catch 22,’ where many consumers remain financially excluded because alternative payment data has not been considered in traditional credit reports.”

“Consumer-permissioned alternative data is a powerful tool to help dismantle the ‘Credit Catch 22.'”

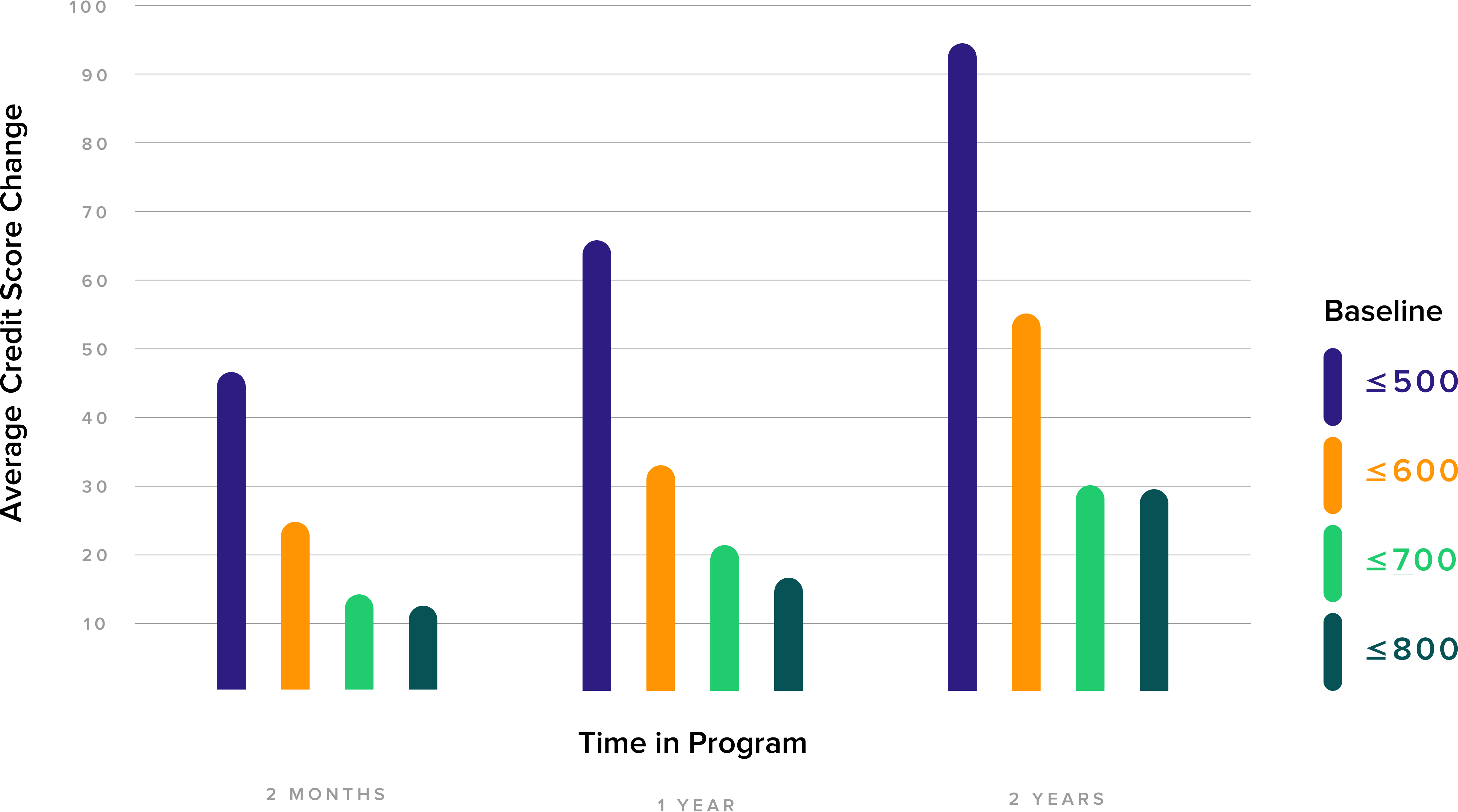

Consumer-permissioned alternative data provides an opportunity for more than 91.5 million credit invisible Americans to build or improve their credit score without having to take on more debt. Incorporating rent and utility payment history into credit models could help approximately 7.6 million consumers who are currently unscorable to earn a credit score of 620 or higher. A recent LevelCredit study found that with incorporation of rental payment data, scores below 600 increased on average 28 points after two months and 70 points after two years.

“Today, the credit industry finds itself at an inflection point with 25% of consumers lacking credit altogether, and a rapidly growing number of additional consumers who are under-represented in credit because they are not homeowners. Not only do consumers want a level playing field when it comes to their data and credit scoring, but lenders, banks, and fintechs need a more complete picture of an individual’s payment history to expand into new markets, many of which are under served due simply to a lack of data,” commented Ian Cohen, president of LevelCredit. “Our goal is to enable everyone to report the positive payment history for their largest monthly expenses, whether they own a home or not. With the Urjanet partnership, we’re expanding this mission in order to deliver more value and improve financial inclusion.”

Urjanet and LevelCredit will be at Money20/20 from Oct. 27-30, the premier global event where influential payments, fintech and financial services brands create and explore the disruptive ways in which consumers and businesses manage, spend, and borrow money. To learn more about this new alternative data solution, please visit booth 4038.

- For more information about how Urjanet utility data can be used for alternative credit scoring, please visit https://urjanet.com/solutions/alternative-credit-data/.

- For more information about LevelCredit, please visit https://www.levelcredit.com/.

- For consumers who want to add your rent payments to their credit report at major credit bureaus each month, please visit https://www.levelcredit.com/how-it-works

About Urjanet:

Urjanet is the world’s leading utility data aggregator, delivering data from more than 6,500 utility, telecom and cable providers across 47 countries. Urjanet’s cloud-based platform and powerful suite of APIs provide a secure and scalable way for businesses to access consumer-permissioned data for credit risk decisioning and identity and address verification. To learn more, visit urjanet.com.

About LevelCredit:

LevelCredit serves as the leader in rent reporting to help consumers add their largest monthly expenses to their credit files. LevelCredit is dedicated to a simple mission: help consumers get the credit they deserve by enabling them to report major expenses that are not currently included in their credit files. Through its three key products — RentTrack Payments, RentTrack Reporting, and Credit Builder– LevelCredit aims to level the playing field for millions of Americans in order to make credit fair and accessible for all. For more information about LevelCredit, visit levelcredit.com.