Blog

The latest news, product updates, energy expertise, and climate perspectives from Arcadia.

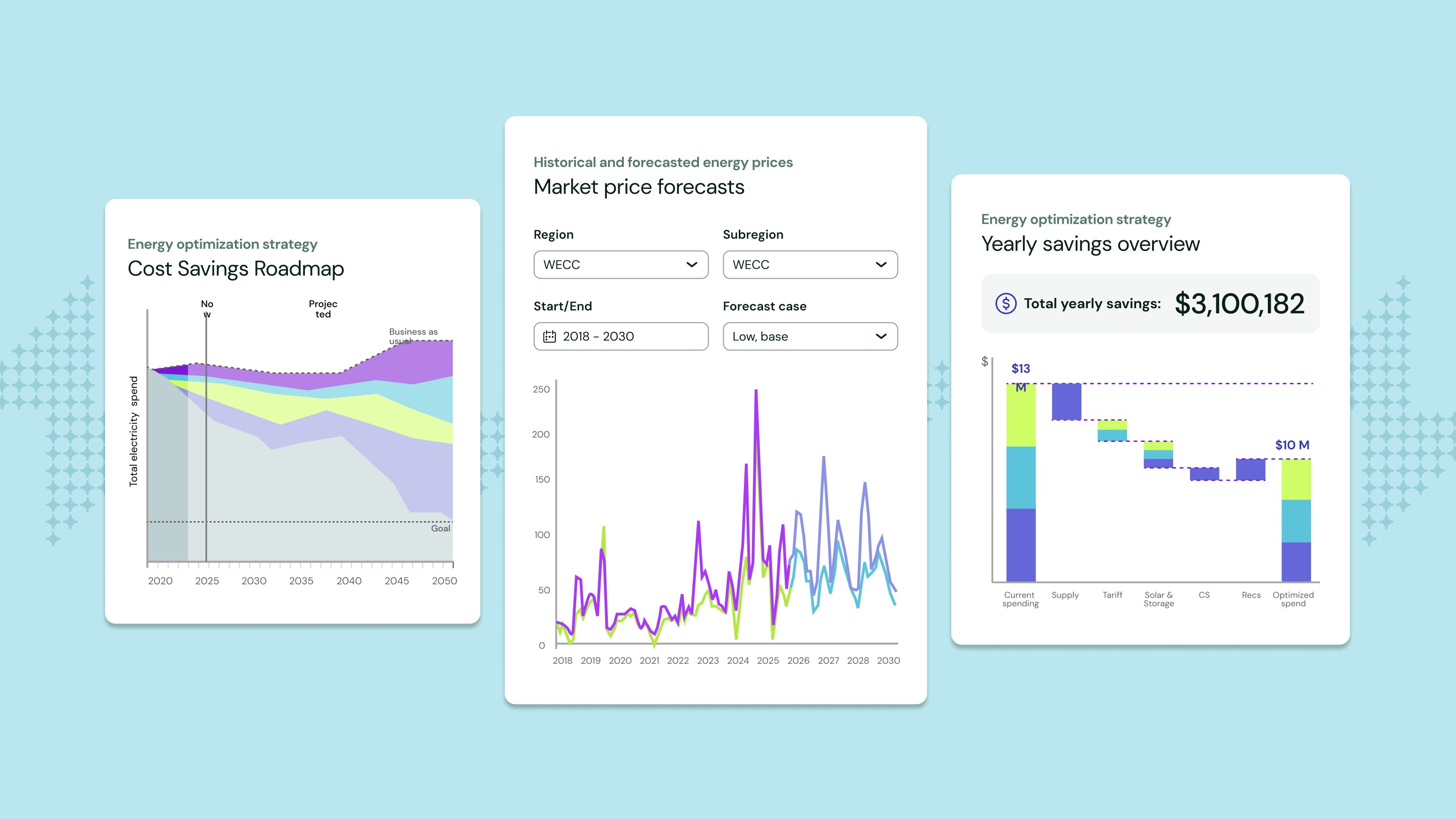

Today's enterprises must adopt a more modern approach to energy management built on unified data, AI-powered tools, and continuous monitoring and optimization.

Featured stories

Our Q&A with Udit Garg, Arcadia’s VP of Product & Engineering, explores why generic AI solutions fall short in today's complex energy landscape — and how Arcadia's experience informs our strategic approach to leveraging AI.

By integrating the expertise of RPD Energy, Arcadia has strengthened our ability to deliver holistic, tailored procurement services for businesses across the US.

Discover how interval utility data can help businesses optimize energy costs, improve efficiency, and achieve sustainability goals.