Blog

The latest news, product updates, energy expertise, and climate perspectives from Arcadia.

In the wake of political uncertainty, ESPM customers need a contingency plan in case their data access is removed, even on a temporary basis. Arcadia can help.

Featured stories

By integrating the expertise of RPD Energy, Arcadia has strengthened our ability to deliver holistic, tailored procurement services for businesses across the US.

Our Q&A with Udit Garg, Arcadia’s VP of Product & Engineering, explores why generic AI solutions fall short in today's complex energy landscape — and how Arcadia's experience informs our strategic approach to leveraging AI.

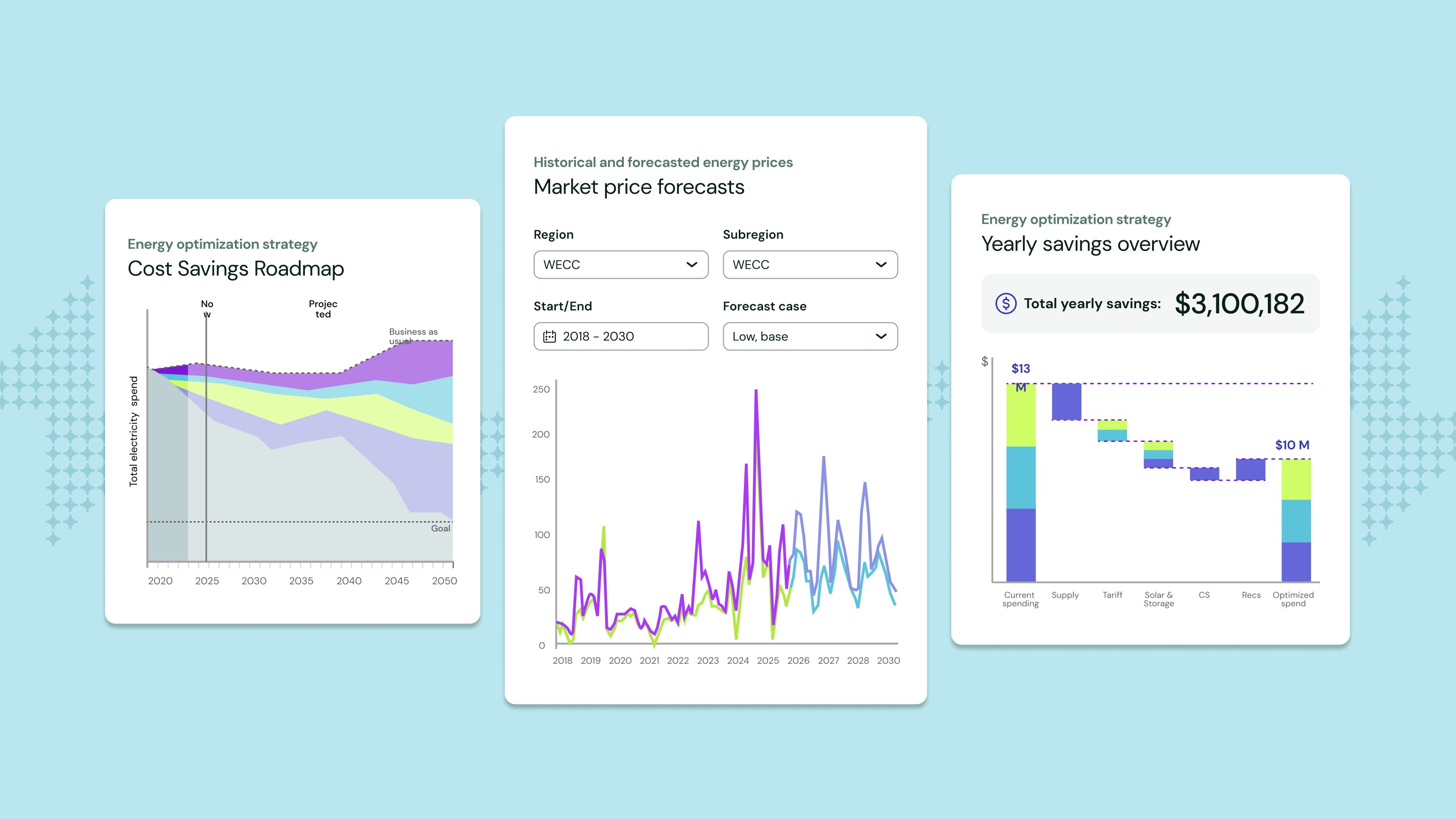

Today's enterprises must adopt a more modern approach to energy management built on unified data, AI-powered tools, and continuous monitoring and optimization.